Recently I wrote about having a charitable giving plan, and how that can allow people to be strategic about their charitable gifts.

Recently I wrote about having a charitable giving plan, and how that can allow people to be strategic about their charitable gifts.

As tax rates have been on the rise lately, many people have been looking for ways to reduce their income tax bill while benefitting the community. The whole point behind the tax deduction of gifts to charities is to encourage successful people to be generous and to support causes that benefit other people in the community at large. Tax efficient charitable giving involves looking at not only your charitable giving plan, but also the best ways to leverage tax breaks for charitable giving.

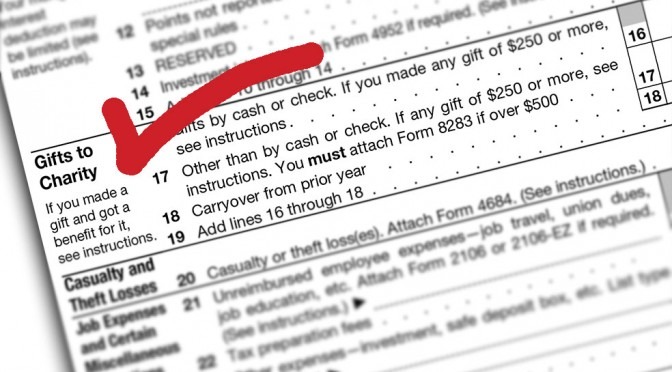

Just because you give money away to charity doesn’t mean that you can write off the full amount of the donation. Contributions to charities are generally itemized deductions, which start to phase out once you hit the 28% federal tax bracket. There are also limits on how much of a contribution you can deduct, depending on the charity. For example, cash donations to a private non-operating (grant-making only) foundation are deductible only up to 20% of your Adjusted Gross Income, whereas gifts to operating charities and donor advised funds are deductible up to 50% of AGI.

Making the most of your gifts.

Suppose, for example, that I wanted to give money to Girl Scouts San Diego. I could write a check for cash, which they would definitely appreciate. On the other hand, if I had stocks or mutual funds that have gone up in value, I could gift the securities instead. If I sold the stocks, and paid any tax on the gains, there would be less money left over for Girl Scouts. But if they sell the stocks, they don’t have to pay tax on the gains and thus receive the full value of the gift. The higher a donor’s tax bracket, the more valuable this strategy for tax efficient charitable giving.

Another option, which Congress will probably renew, is the Qualified Charitable Distribution from your IRA for donors over 70½. This is a distribution, up to $100,000 total, directly to a charity from your IRA and can satisfy some or all of your required minimum distribution. Such a distribution is not deductible, but unlike other IRA distributions, it doesn’t count as income, either. The beauty here is that you can give up to $100,000 to charity that CAN’T BE PHASED OUT like ordinary gifts.

A third option, useful for very large transfers, is called a Charitable Lead Trust (CLT). This is a sophisticated estate planning tool that, in today’s low interest rate environment, can generate very large tax deductions while transferring income generating assets to your heirs. In very rough terms, the donor creates a special trust and transfers income generating assets to the trust for a number of years. While the trust owns the assets, the income goes to the chosen charity. At the end of the period, your heirs receive the assets from the trust.

The donor receives a deduction today based on the total value of the income paid to the charity from the trust. The high deduction lies in a financial calculation of the present value of the income stream to the charity: the lower the interest rates when you start the trust, the higher the present value of the payments to the charity over time.

One final tax efficient charitable giving strategy is a charitable bequest. Most charities will work with donors to help them create gifts out of their estate after the donor passes away. The advantage here is that you get to use the assets as long as you need them, and leave whatever is left over to charity.

These are only a few of the ways that we can support the causes that mean the most to us while maximizing the incentives currently built into the tax code. Before you make large gifts to your favorite charities, you should consult your financial team (attorney, accountant and financial advisor) to make sure it fits within your overall strategy. Please give us a call if we can be of assistance helping you determine the tax efficient charitable giving strategy that’s right for you.

First you want to learn the mission of any charity you’re considering. If you have a specific charity in mind for the car donation do some research on it, especially if you’re not sure how reputable the charity is. There are many national and local charitable organizations that advertise in newspapers or on television and openly announce they are looking for car donations. You have probably seen some of these, but are they your best choice?

Great question about donating an automobile to charity. (And thanks for the reminder to all about making sure your charity is reputable first!)

I think that whether car donations are your “best choice” depends on 1) how hard you want to work to sell the car to maximize your value, and 2) how much the charity will ultimately benefit. For example, if they can only auction the car for $1,000 but you can sell to a private party for $1,500, then you would both come out ahead selling the car privately and giving the charity a $1,000 check. But that will take more work on your part.

So the answer is: “What’s the best choice for you personally?