You’ve spent years pursuing education and training. Now, you’re busy healing and treating others. Let us help you live the rewarding and fulfilling life you dream about.

Let us partner with you to co-create and implement sustainable, long-term plans that support your definition of success. We’ll engage in robust discussions, whether it’s about buying a new house or paying down debt, so you can make informed financial and life decisions.

Thoughtful and caring advice

Sounding board for financial and life decisions

Access to custom tools to lay out your goals and milestones

Help with prioritizing and tracking progress toward your goals

Partner with your tax preparer to implement tax deferral strategies

Build your team of professionals to support your financial and legal needs

15-minute consults and check-ins

Easy online scheduling

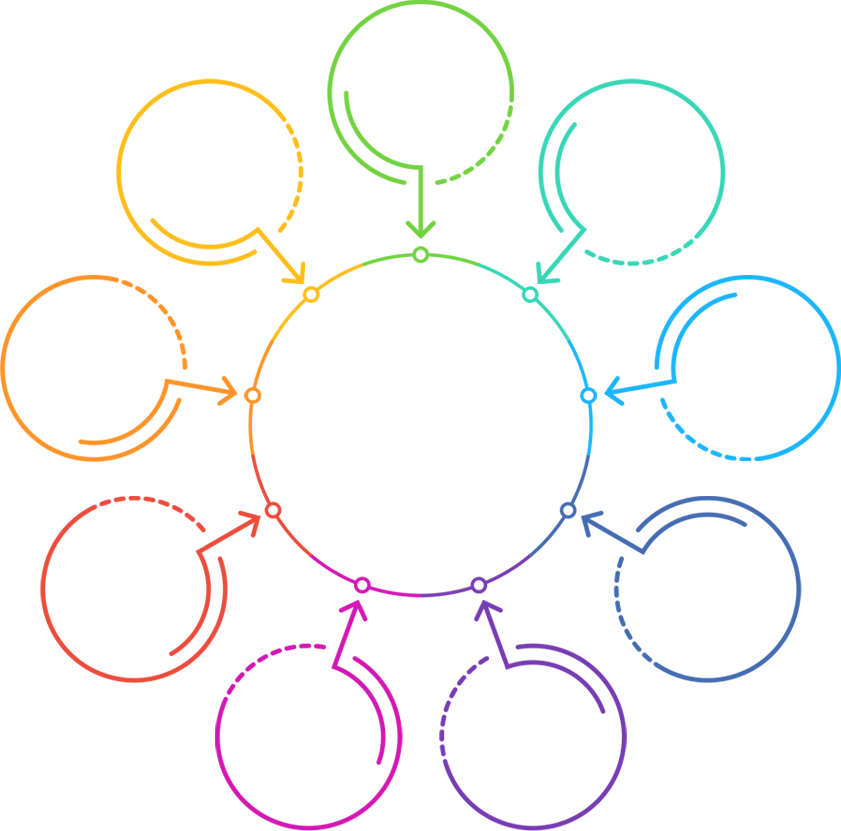

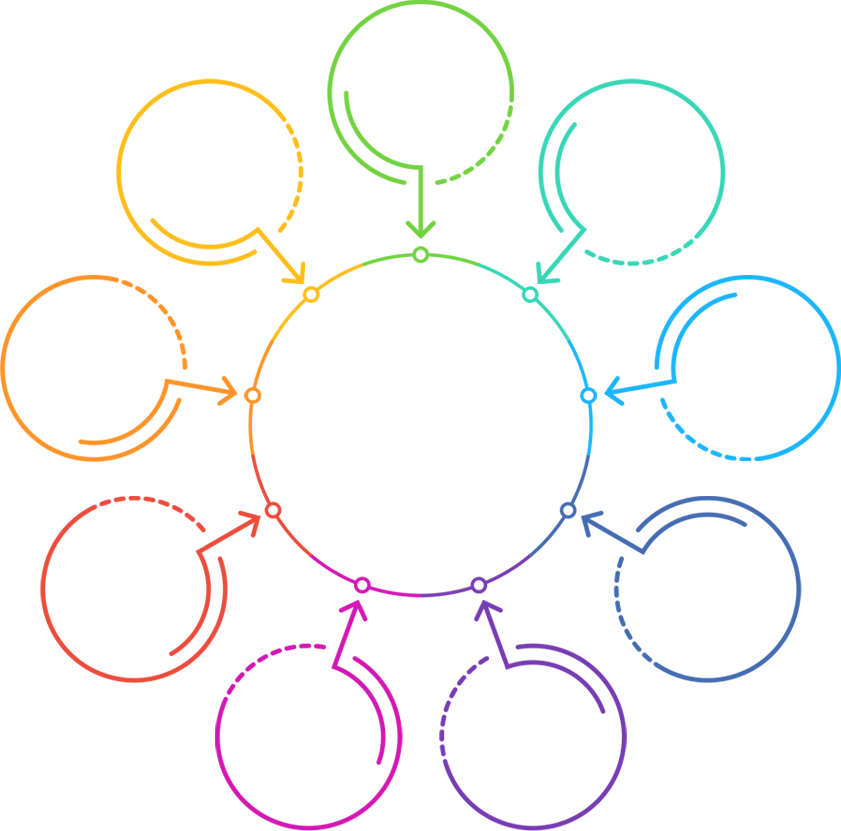

CLEAR GOALS AND VALUES

CLEAR GOALS AND VALUES

DEFINED STEPS TO FINANCIAL INDEPENDENCE

DEFINED STEPS TO FINANCIAL INDEPENDENCE

SIMPLE AND AUTOMATED SAVING STRATEGIES

SIMPLE AND AUTOMATED SAVING STRATEGIES

LOW COST AND DIVERSIFIED PORTFOLIO

LOW COST AND DIVERSIFIED PORTFOLIO

A SUSTAINABLE SPENDING PLAN

A SUSTAINABLE SPENDING PLAN

SENSIBLE DEBT REDUCTION STRATEGY

SENSIBLE DEBT REDUCTION STRATEGY

INSURANCE TO PROTECT YOU AND YOUR FAMILY

INSURANCE TO PROTECT YOU AND YOUR FAMILY

ESTATE AND LEGACY PLAN THAT REFLECTS YOUR WISHES

ESTATE AND LEGACY PLAN THAT REFLECTS YOUR WISHES

MULTI-YEAR TAX PLANNING

MULTI-YEAR TAX PLANNING

Our Advisors will guide you in:

For managed portfolios over $600,000, please see our standard fee structure here. Minimum fee does not apply.

CLEAR GOALS AND VALUES

CLEAR GOALS AND VALUES

DEFINED STEPS TO FINANCIAL INDEPENDENCE

DEFINED STEPS TO FINANCIAL INDEPENDENCE

SUSTAINABLE RETIREMENT INCOME AND SPENDING PLAN

SUSTAINABLE RETIREMENT INCOME AND SPENDING PLAN

LOW COST AND DIVERSIFIED PORTFOLIO

LOW COST AND DIVERSIFIED PORTFOLIO

RETIREMENT BENEFITS EXPLAINED AND OPTIMIZED

RETIREMENT BENEFITS EXPLAINED AND OPTIMIZED

LONG LIFE PLANNING PARTNER

LONG LIFE PLANNING PARTNER

INSURANCE TO PROTECT YOU AND YOUR FAMILY

INSURANCE TO PROTECT YOU AND YOUR FAMILY

ESTATE AND LEGACY PLAN THAT REFLECTS YOUR WISHES

ESTATE AND LEGACY PLAN THAT REFLECTS YOUR WISHES

MULTI-YEAR TAX PLANNING

MULTI-YEAR TAX PLANNING

Our Advisors will guide you in:

| Assets Under Management (AUM) | Advisory Fee (% AUM) |

|---|---|

| First $1,000,000 AUM | 1.0% |

| $1,000,001 - $3,000,000 AUM | 0.75% |

| $3,000,001 - $5,000,000 AUM | 0.60% |

| In excess of $5,000,000 AUM | 0.40% |

Minimum fee: For Assets Under Management less than $1,000,000, a minimum fee of $2,500 per quarter applies.

For more information about our minimum account size and fees, click here.