Quarter in Review

The big story in the first quarter of 2023 was the failure of Silicon Valley Bank, Credit Suisse and two other regional banks, representing the largest banks to fail since 2008. This caused a brief period of instability in the capital markets and in banking in particular, but it also likely had a longer-term impact on the availability of credit to businesses and consumers alike. More on that in a bit. While the economy grew at about 2.6% in the fourth quarter of 2022, it likely slowed a bit in the first quarter of 2023, with the Federal Reserve Bank of Atlanta’s GDP Now estimate at about 1.5% on April 5.

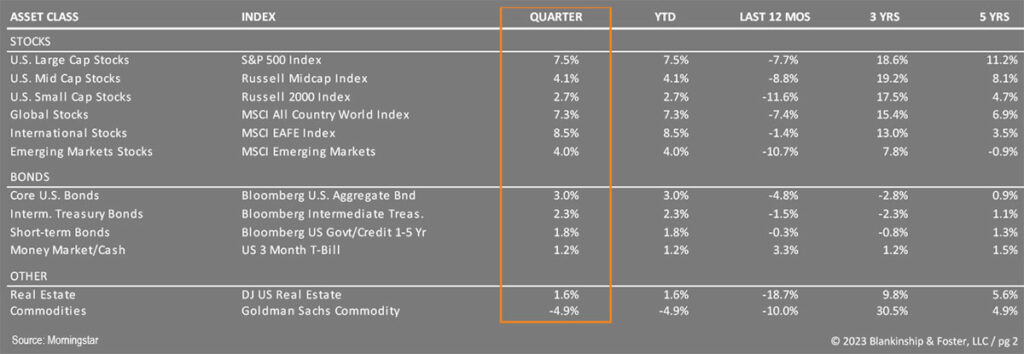

Somewhat counterintuitively, Investors largely cheered the slowing economy because a slowing economy makes it less likely that the Federal Reserve will raise interest rates further. Despite the volatility surrounding the bank failures, capital market returns were largely positive during the quarter. The S&P 500 Index of large U.S. companies rose 7.5% in the first quarter. Smaller companies, represented by the Russell 2000 Index, gained just 2.7% while international stocks represented by the MSCI EAFE Index rose 8.5%. The bond market benefitted from the sense that significant further interest rate hikes were unlikely. The benchmark 10-year Treasury yield fell slightly to 3.48%, resulting in a gain for most bond categories. The Bloomberg U.S. Aggregate index gained 3.0% in the quarter while High Yield “junk” bonds rose 3.7%. The Dow Jones US Real Estate Index rose 1.6% while last year’s star asset class, commodities, dropped 4.9%.

Economy

Once again, the economy is not currently in a recession. Looking at the indicators that the National Bureau of Economic Research (which determines when recessions begin and end), it’s clear that the economy is still growing, though at a slower pace than in the fourth quarter. Many indicators are softening, such as personal incomes, industrial production and consumer spending, but not to the point of going into reverse.

Inflation continued to moderate during the quarter, falling from 7.8% year-over-year growth in October to 6.0% in February. Most forecasters expect a continued downward trend in inflation over the course of the year, possibly ending the year around 4%.

The labor market remains strong but is losing some momentum, though unemployment remains solid at around 3.5%. Wage growth has eased and layoff announcements are ticking up, signaling some future weakness in employment in the months ahead. A cooling labor market should continue to put downward pressure on inflation, meaning the Federal Reserve (Fed) may not have to continue to raise interest rates as fast as they have over the past year.

Another factor that will influence the Fed’s thinking was the failure of a few regional banks during the quarter because those failures were caused in part by the Fed’s interest rate hikes. To be clear, as one bank executive told us, the fundamental issue was that these banks “failed banking 101” by failing to manage their interest rate risk and failing to diversify their depositor base. But it did expose some weaknesses in the banking system, forcing the Fed to ease up on the brakes a bit. From the Fed’s perspective, bank executives will likely be more stringent in who they lend money to going forward, so some of the work of slowing the economy may be done by bankers tightening lending standards rather than by the Fed raising interest rates. The outcome is likely to be the same: somewhat slower growth in the months ahead.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Higher interest rates continue to put pressure on the housing market, while changes in Federal spending also impact the economy. While it is generally a good thing that the Federal budget deficit is decreasing as a percentage of the economy, it does mean that the government is spending less money and thus providing less support for the economy going forward. It’s important to remember that huge federal government outlays during the pandemic did contribute to inflation. But like a sugar high that’s worn off, reduced federal spending today is a drag on current economic activity.

Globally, central banks outside the U.S. have raised interest rates while manufacturing activity is softening in the U.S., Asia and Europe, even as Services remain strong. Interestingly, rates are expected to fall faster in the U.S. than abroad, possibly putting downward pressure on the dollar and making international investments more attractive.

Outlook

Many factors have contributed to a slowing economy, and it’s not a foregone conclusion that a recession must occur. But it does seem more likely, and the consensus seems to point to a recession beginning sometime this year, but again this isn’t certain. Once again, our dashboard shows lots of caution lights, but no bright red indicators. Year-over-year corporate profits have fallen dramatically over the past year, and corporate spending on big-ticket investments are likely to follow soon.

Looking forward, current valuations on stocks and bonds are more attractive than they’ve been in years. The five-year expected returns on investments have improved significantly, though we can’t rule out falling prices (and thus improved future returns) in the coming months if a recession does occur. Even though stocks have risen recently, bond markets have priced in a fairly significant reduction in interest rates, signally an expectation of a recession in the coming quarters. We would not be surprised by a drop in stock prices followed by a strong recovery by year-end, though other scenarios are also possible.

More to the point, it’s nearly impossible to time stock market movements like that. For example, historical periods when consumer sentiment about the economy was at its worst were some of the best times to buy stocks. Equity prices are likely to be volatile this year as investors weigh the impact of a looming (or avoided) recession and negotiations in Washington around raising the debt ceiling, among other geopolitical concerns.

Our Team

As a client of Blankinship & Foster, you have a dedicated team of financial advisors, service and support professionals.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies. Our value bias has helped improve performance despite the broad weakness of U.S. stock markets so far this year, and generally speaking, value companies tend to outperform when interest rates and inflation are higher. Our international exposure remains balanced between hedged and unhedged investments and benefits from more attractive valuations than comparable U.S. equities.

Today’s higher interest rates mean that expected bond returns going forward are more attractive than they were a year ago. More importantly, if our expectation of a recession is realized, interest rates will likely settle back down, providing good returns to bonds should stocks falter heading into a recession. Bonds should be a better diversifier this year, especially if markets are correct in forecasting lower interest rates heading into 2024.

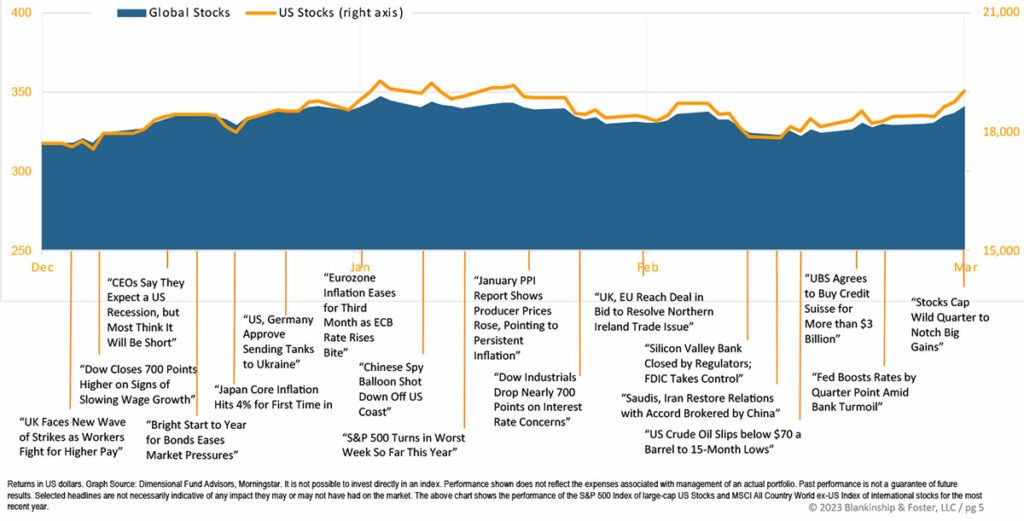

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

In short, we continue to expect volatility as investors prepare for a possible recession and adjust their estimates for stock prices accordingly. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

DISCLAIMER:

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website.