Quarter in Review

As we wrap up 2022, it’s certainly been one for the history books. Across the globe, inflation spiked to levels not seen in decades. Europe was (and still is) wracked by the largest conflict there since 1945. The COVID pandemic is finally moderating but continues to impact millions, even as China relaxed its draconian COVID restrictions. And U.S. capital markets had one of the worst years on record, with bond prices falling more than any year since 1974. It’s been an interesting year, to say the least.

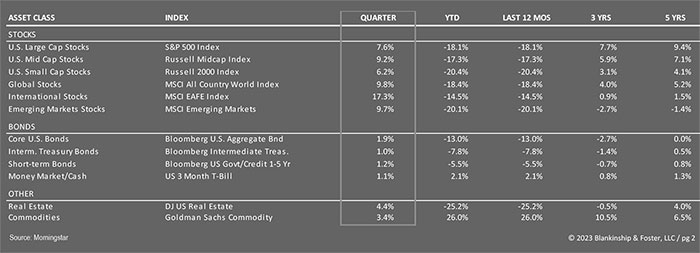

2022 was the worst year for stocks and bonds together since 2008 and the third worst since 1974. Few investments were positive last year besides cash. Despite gaining 7.6% in the fourth quarter, the S&P 500 Index of large U.S. companies fell 18.1% for the year. Smaller companies, represented by the Russell 2000 Index, rose 6.2% in the quarter, off 20.4% for the year. The MSCI EAFE Index of stocks of companies in developed countries outside the U.S. gained 17.3% in the quarter as the dollar reversed course and fell. International stocks were still off 14.5% for the year. The bond market had a bit of a reprieve as well with the 10-year Treasury yield little changed during the quarter. The Bloomberg U.S. Aggregate index gained 1.9% in the fourth, cutting its year-to-date loss to “only” 13.0%. High yield “junk” bonds were off 11.2% for the year and the Dow Jones US Real Estate Index finished the year down 25.2%. Cash and commodities were the only bright spots for the year, up 2.1% and 26.0% respectively. Despite the blockbuster year for commodities, the S&P GSCI commodity index is down 3.3% per year for the last 10 years including this recent positive performance, so this year’s gain came at a significant long-term cost.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Economy

Looking ahead, let’s start with some good news. Inflation is finally moderating, with the latest reading of the Consumer Price Index at “only” 7.1% year-over-year. The inflation spike last year was caused by a toxic combination. During the COVID pandemic, a lot of people were stuck in their homes buying goods instead of services. Snarled supply chains meant those goods couldn’t make it from factories to consumers, so prices increased. At the same time, the U.S. policy response poured money into consumer and business coffers, adding fuel to the fire. Finally, Russia’s invasion of Ukraine caused a huge spike in the price of food and energy. Core goods price inflation has mostly eased, as have food and energy prices. Analysts expect this trend to continue as supply chains are largely repaired but consumer spending is slowing down, reducing demand for the resupplied goods.

Labor demand remains solid, with the ratio of job openings to job seekers close to 1.7, a historically high level. Companies that have had such a hard time hiring workers for the last two years may be more reluctant to let them go if the economy does slow this year. In any event, with unemployment still running near a historically low level, it’s hard to say we’re in a recession at the moment. Unemployment is a lagging indicator and does typically rise in a recession, but a combination of COVID deaths, early retirements and decreased immigration have created a massive shortage of workers. It’s hard to imagine a scenario where unemployment increases significantly.

Economic growth appears solid in the fourth quarter, though slowing into 2023. The Federal Reserve Bank of Atlanta’s GDP Now estimator shows a reading of approximately 4.1% growth for the fourth quarter, but most analysts we read expect a recession to begin sometime during 2023. This is supported by an inversion in the Treasury Yield curve. When longer-dated bonds yield more than short-term bonds, it’s a reliable indicator that a recession is coming. But it isn’t a very timely indicator, as it can be several quarters before a recession actually begins.

With that said, most seem to expect a relatively mild recession rather than a sharp drop in activity. JP Morgan likened it more to “walking into a swamp than falling off a cliff”. So we wouldn’t be surprised to hear the “R” word a lot more in coming months, and investors will certainly be looking for clues as to the direction of the economy and by extension, corporate earnings.

Outlook

As we wrote last month, the current expansion is slowing but still seems to have some momentum. We do expect the Federal Reserve to raise interest rates at their next meeting, and possibly the following one, but those increases should be more muted. Bond investors appear to be expecting rates to begin falling by the end of the year, likely as a result of a recession forcing the Fed to lower interest rates again.

As we pointed out last quarter, the typical post-war recession has lasted about 10 months and resulted in a drop of about 3% of Gross Domestic Product. Housing, the epicenter of the last recession, and family balance sheets are in better shape this time around. Also, today’s tight labor market may also serve to dampen the impact of a potential recession.

Our dashboard shows a lot of caution lights, but no bright red warnings yet. Corporate earnings estimates don’t seem to have fully absorbed the risks of recession, so there is likely downside risk to stock prices in the near-term, but it’s nearly impossible to predict when that will happen or how far prices may fall.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Looking forward, current valuations on stocks and bonds are more attractive than they’ve been in years. Five year expected returns on investments have improved significantly, though we can’t rule out falling prices (and thus improved future returns) in the coming months. We would not be surprised by a drop in stock prices followed by a strong recovery by year-end, though other scenarios are also possible.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies. Our value bias has helped improve performance despite the broad weakness of U.S. stock markets last year. Our international exposure benefitted from our blend of currency hedged investments, which outperformed as the dollar strengthened earlier in the year, and unhedged positions which soared in the fourth quarter. Improved valuations (much lower price to earnings multiples) suggest that stocks are poised for better performance over the next five to ten years, but a recession in the coming months or quarters will delay the start of any recovery in equity prices.

Today’s higher interest rates mean that expected bond returns going forward are significantly better than they were this time last year. More importantly, if our expectation of a recession is realized, interest rates will likely settle back down, providing good returns to bonds, which should help if stocks falter heading into a recession. This would be a welcome change from 2022 when bonds fell almost as much as stocks.

In short, we expect more volatility in 2023 as investors prepare for a possible recession and adjust their estimates for stock prices accordingly. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every major market decline.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Going Green

We have been working with our technology vendors and are excited to announce that we are able to deliver your quarterly reports to you via our secure online portal. This will help to save paper and is actually more secure, since you can only access the reports through a secure internet connection.

If you would like to save a few trees (and make the reports available whenever you’re ready to read them), then please email your advisor and ask about converting your reports to electronic delivery.

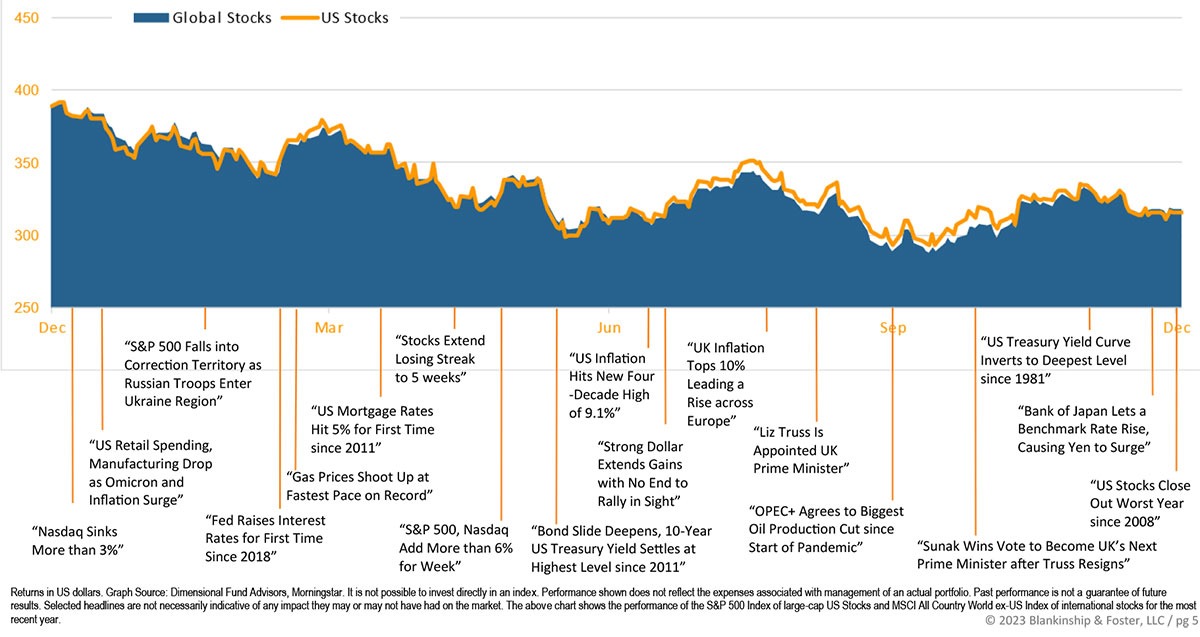

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

DISCLOSURE:

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.