Quarter in Review

The first half of 2020 will likely go down as a very difficult time in modern history. A global pandemic has already killed half a million people worldwide and more than 127,000 here in the U.S. Efforts to halt or delay the spread of COVID-19, including forced lockdowns and social distancing, have triggered a very deep recession. Even with a partial reopening and impressive employment gains in the past two months, more people are currently unemployed than at any time since 1942. Massive stimulus from both the federal government and the Federal Reserve have softened the economic impacts of the recession and have probably taken the worst-case outcomes off the table. However, the cost of the stimulus has added trillions of dollars to the Federal deficit.

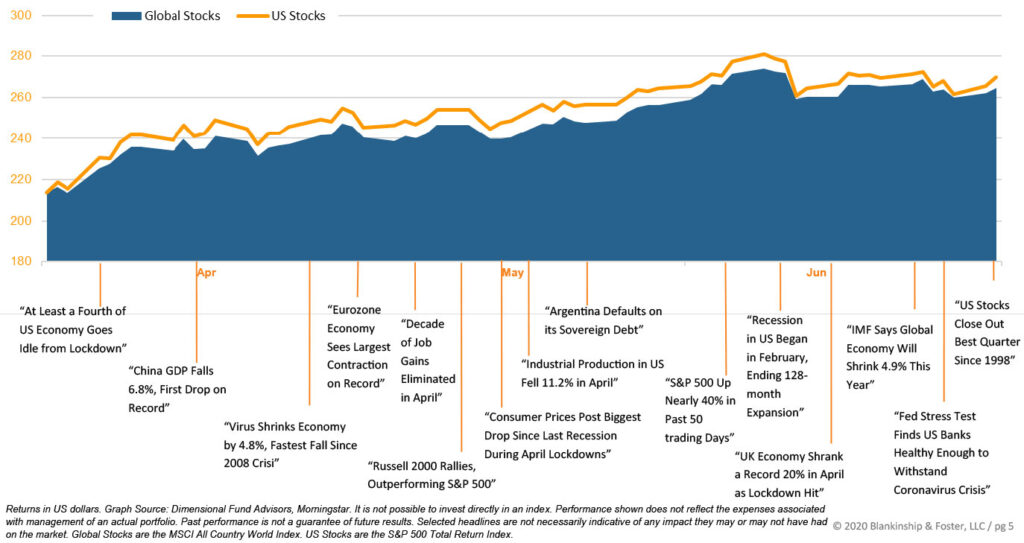

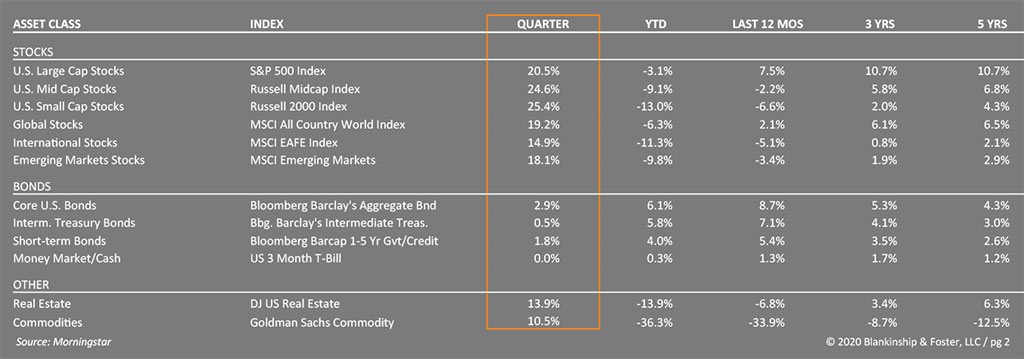

The U.S. equity markets recovered quickly during the second quarter despite the economic and political instability, shrugging off rising COVID-19 cases in late June and the social unrest following the death of George Floyd. Large U.S. company stocks, represented by the S&P 500 Index, gained 20.5% during the quarter, ending June off just 3.1% year-to-date. Smaller company stocks surged 25.4%, but are still off almost 13% for the year. International stocks recovered as well, rising 14.9% during the quarter, though still off 11.3% year-to-date. Bonds turned in solid gains, with the Bloomberg Barclay’s US Aggregate Bond Index rising 2.9% for the quarter.

Economy

During May and early June, the U.S. had appeared to be gaining ground on the pandemic as new cases slowly ebbed and New York City, the epicenter for most of the year, saw a drop in COVID hospitalizations and ICU bed usage. Unfortunately, what had looked like a promising trend in dealing with the pandemic has reversed course. States that reopened their economies too early or too quickly have become new hot spots, exacerbated by resistance to adhere to recommendations from public health professionals calling for social distancing and mask wearing. In the coming weeks, we should begin to see a clearer picture of the pandemic’s trajectory and its impact on the economic recovery.

It is our view that the economy will not fully recover until the pandemic is under control. As of June 30th, there were more than 2.6 million confirmed cases of COVID-19 in the U.S., and over 127,000 fatalities. However, experts estimate that due to the shortage of testing capacity, the case count is likely closer to ten times that number. As we write this, average new daily cases have been steadily climbing, indicating extensive spread of the virus throughout many previously unaffected communities across the U.S. This resurgence of the virus will slow the recovery, making it unlikely that things will return to ‘normal’ anytime soon.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Gross Domestic Product (GDP), the sum total of goods and services produced in the U.S., is estimated to have fallen significantly during the second quarter, with the Wall Street Journal consensus at –33.5% for the quarter and –6% for the full year. To put that in context, the 2008 financial crisis saw GDP contract by about 4%. Despite this stunning economic impact, capital markets largely recovered during the quarter on the expectation of a short, sharp recession and a quick return to profitability for businesses.

We have our doubts about this optimism. Some industries were barely impacted by the pandemic, able to function with few or minimal changes to daily operations. Others, like airlines, hotels, sit-down restaurants and sporting events, are likely to continue to suffer until the pandemic is fully behind us.

Many of the industries most impacted by the pandemic are labor intensive. Unemployment spiked to a post-Depression record of 13.3% and has recovered down to about 11% but could remain stubbornly high as the pandemic continues to alter consumer and business activity. This in turn will impact the demand for goods and services and the speed of the recovery. In short, while we have seen a sharp rebound from the depths of the economic slowdown, the rest of the recovery is likely to be much slower, at least until a vaccine is readily available.

In short, even as economies reopen and goods become increasingly available, weak demand due to lost income and fear of COVID transmission will likely keep a lid on the recovery, and inflation, for the foreseeable future.

Outlook

Investors should be prepared for volatility as corporate prospects and the future of earnings start to come into focus in the coming weeks. We expect to see something of a tug-of-war between optimism and caution related to the pandemic. This could spill over into asset prices as new cases surge and ease and new treatments are announced.

Current expectations for corporate earnings are for companies to rebound to record profits by 2021. Since this scenario seems to be fully priced into stock markets, any deviation from this scenario can negatively impact stock prices. The question is whether fundamentals (like revenues and profits) catch up to stock prices or if stock prices catch down to fundamentals. That is nearly impossible to predict with any confidence. It also seems likely that once a vaccine is found and people again begin to resume normal pre-crisis behaviors, there could be a large pent up demand for travel and entertainment, fueling a strong boom in these industries.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

One of the big questions facing investors is how the economic recovery and fiscal and monetary stimulus will impact interest rates. The short answer is that the Federal Reserve has made it clear they plan to keep interest rates low for a long time. This will likely push investors seeking income into higher yielding, riskier assets like stocks and low-quality corporate bonds, fueling additional gains in these assets. That said, high quality, low risk government bonds remain the best tool in portfolios for risk reduction.

As we look beyond the U.S., Europe and most of Asia have largely put the pandemic behind them and are starting to show signs of recovery. If this pattern continues, we could see better growth in international markets in the coming quarters. Additionally, if the U.S. continues to struggle with the pandemic, fewer countries may be willing to trade with the U.S., putting downward pressure on the dollar (with trade picking up between other countries).

Many emerging markets continue to struggle with the pandemic, especially in Latin America. That said, as the pandemic runs its course and economies begin to recover, the composition of emerging markets will be a significant plus. Most emerging markets indexes are heavily weighted to the kinds of companies that rise and fall with the economic cycle. As growth has slowed, that has proven a challenge. As the pandemic comes under control and growth recovers, this should benefit emerging markets stocks, especially considering these stocks are significantly cheaper than U.S. or even developed market stocks in Asia and Europe. A falling dollar could further benefit emerging market investments.

A significant challenge does lie on the horizon for international equities. Trade tensions with China, which had been cooling, appear set to increase as the Trump Administration looks to punish China for hiding the depth and severity of the original COVID outbreak there. In addition, trade tensions with Europe may be heating up as well over taxation of U.S. corporate profits (especially big tech companies like Google and Apple). Further disruptions to international trade may cause investors to rethink growth and earnings assumptions.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Our Portfolios

Generally speaking, our portfolios have held up well during the recent market decline and subsequent recovery. Rebalancing (selling bonds and buying cheaper stocks) has played a role, as has the discipline of simply staying the course even when markets are turbulent.

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields.

We continue to review the current conditions, evaluating a shift towards smaller and cheaper “value” stocks. We have also maintained a sizeable portion of our stock exposure in international funds and expect to benefit from decent growth and better valuations as economies begin to recover from the pandemic.

As we said already, we are not completely convinced we are out of the woods, but it does seem the worst of the market volatility is behind us. That does not mean that stocks cannot trade lower, especially with rising number of states re -imposing partial shutdown measures. We anticipate some volatility as the economy tries to get its legs back under it while businesses and consumers are adapting to the new “socially-distanced normal”.

As always, we are here for you and we are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.