Quarter in Review

What a difference a year makes. Just 12 short months ago, the stock market was reeling as investors began to digest the economic impact of the COVID-19 pandemic. One year (and several record highs on the stock markets) later, investors are looking forward to a strong surge in economic activity. As vaccination programs gain traction nationwide and statewide restrictions on business, movement and activity are lifted, economists expect a surge of activity from pent-up demand and a desire to return to something approaching normal. While mask wearing in public may continue, dining out, travel and even movies and theaters should begin to make a comeback. As vaccinations continue and Covid risks appear to moderate, additional fiscal support from Congress (the $1.9 Trillion American Rescue Plan Act of 2021 passed in March) seems poised to add fuel to an economy already heating up.

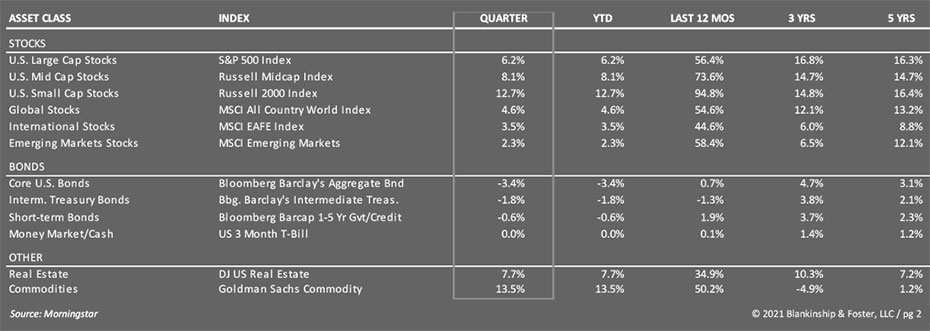

Large U.S. company stocks, represented by the S&P 500 Index, gained 6.2% during the first quarter while smaller company stocks surged 12.7%. International stocks rose 3.5% as Europe’s vaccination program stumbled amid new outbreaks. The yield on the 10-year Treasury note rose from 0.74% to 1.67% (when interest rates rise, bond prices fall) and as a result, the bond market slid 3.4% for the quarter. Other assets were somewhat mixed. Real estate was up 7.7% while high yield (“junk”) bonds were up only 0.9%.

Economy

Before getting into the economic conditions, it’s important to put it in the context of the pandemic. Roughly 30% of the U.S. population has been vaccinated. Considering that roughly 3 million shots are administered every day and adding those who have already been exposed to the Coronavirus, it’s reasonable to estimate that more than half of the U.S. population may have at least some immunity to the virus at this point. This brings us closer to the estimated 70-80% needed for herd immunity (where the virus can’t live long enough to make it to the next person to infect). As we approach this point, we should see a return to something approaching pre-pandemic normal activity.

With that as a backdrop, the aggressive federal stimulus response to the pandemic is expected to help fuel activity once people feel more comfortable getting out and about. Employment has been picking up as the last of the workers affected by the pandemic are starting to come back to work. This will take time, but we could see unemployment hit 4-5% by the end of the year and possibly even back to 3.5% next year. GDP growth could hit as high as 6-7% this year before falling back to the trend growth rate of 2-2.5% next year. During the past 12 months, the most important sectors to the U.S. economy (technology, communication services, health care) really weren’t negatively impacted by the pandemic. Some even saw stronger revenues. When combined with the narrowest of electoral margins in the Senate elections last year, the outlook for corporate profits is pretty good. We could see some pressure to raise corporate taxes in later years, but it’s unlikely to happen this year so probably won’t impact earnings expectations for a while.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

The real challenge to the economy will be inflation. As the economy heats up and jobs become scarce, we could see upward pressure on wages, which is one of the things that’s really necessary for higher inflation. A year ago, the onset of the pandemic and the resulting collapse in trade and oil prices pushed year-over-year inflation almost to zero. With the recovery in trade, some supply shortages and the recovery in oil prices, we are likely to see inflation running a little over the 2% level that we’re used to seeing. The Federal Reserve has made it clear that they will allow this to happen in order to keep the average inflation over longer periods at about 2%.

This impacts interest rates, which have already risen this year. The 10-year Treasury, which hit 0.52% last August, has risen almost back to where it started 2020. It opened 2020 at 1.88% and ended March 2021 at 1.74%. As the economy strengthens and inflation pressures rise, we expect interest rates to slowly trend higher. These are all the right reasons for interest rates to rise, but it will dampen the returns for fixed income investors if rates do climb higher. Fixed income (bonds) are still important diversifiers but cannot be relied upon for high gains in the coming years.

Outlook

With strong growth and improving optimism, corporate profits should hit records again in 2021. Much of this growth seems to have been priced in already, so investors should be prepared for volatility as the focus returns to valuations and future prospects. With low inflation, low interest rates and robust fiscal stimulus, the conditions are present for strong stock market returns despite the high valuations. Since this scenario seems to be priced into stock markets, any disappointment in the economic news could negatively impact stock prices. We would not be surprised to see some kind of a pullback in stock prices, but with all the stimulus in the system, any such period of weakness is not likely to last.

As we look beyond the U.S., most of Asia has put the pandemic behind them and are showing signs of recovery and impressive growth. Cheaper valuations and promising a global economic recovery offer a very attractive mix in overseas investments. Further economic weakness in the U.S. relative to the rest of the world combined with very low interest rates should put downward pressure on the dollar, further improving the appeal of overseas investments.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far. We have been adding to our holdings of smaller company stocks, which should benefit as economic growth broadens and accelerates. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields. Fixed income investors should not expect much from the bond market as gradually rising interest rates and fairly tight credit spreads mean there is little to be excited about in either Treasury bonds or corporate bonds. Bonds remain attractive shock absorbers when stock market volatility arises, and thus are still an appropriate and meaningful part of a diversified portfolio.

We have also maintained a sizeable portion of our stock exposure in international funds and expect to benefit from decent growth and better valuations as economies begin to recover from the pandemic.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

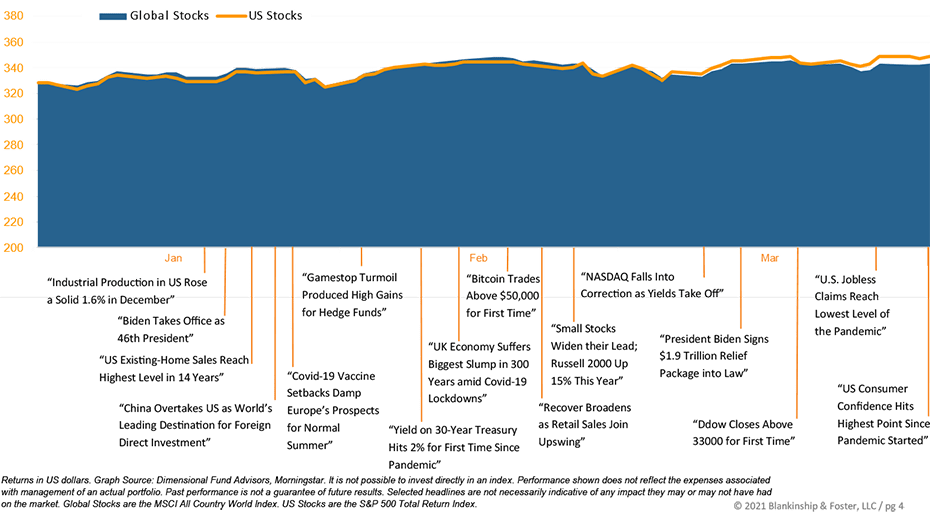

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.