After years of arduous medical training, many young physicians are eager to celebrate their new career with the purchase of their first home. The high amount of debt and low savings could make this dream discouragingly out of reach—banks typically require not only a large down payment, but also proof of past income, both of which are impossible to produce for a physician fresh out of training. However, banks do recognize the unique circumstances and the income potential of a young physician, so many offer physician mortgage loans to make home ownership possible. In California, with its high cost of living, this option is especially attractive to young doctors.

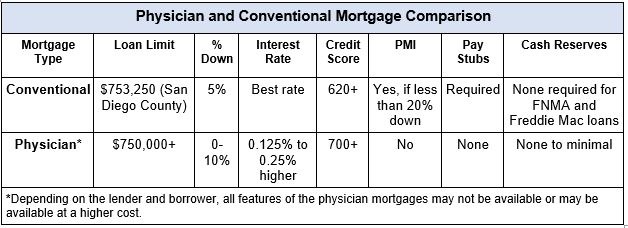

Unlike a conventional loan, which requires a Private Mortgage Insurance (PMI) with down payment less than 20%, a physician mortgage loan necessitates 0-10% down payment and waives the PMI, saving you hundreds of dollars off your monthly mortgage payment. Additionally, these loans make allowances for medical school debt and will generally accept a signed employee contract as proof of income. The interest rates of these loans, however, are usually higher than conventional loans.

Physician mortgage loans are available not only to medical doctors (both MD and DO) but also dentists, orthodontists, and other health care specialists. They are typically offered to those buying or refinancing their primary residence, not second or vacation homes. Some lenders could approve a physician loan for a two- or four-unit investment property if the buyer uses one unit as a primary residence.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Are they a good deal?

Together with a trusted financial advisor, a young physician must weigh the pros and cons of home ownership and a physician mortgage loan. Most physicians complete their training with very little savings to invest in a down payment, and conventional loans require PMI for loans with less than 20% down. A lower down payment and the absence of PMI will increase your cash flow, allowing you to save more of your income. Additionally, a lender will offer a higher loan amount for a physician mortgage loan versus a conventional loan.

In these loans, lenders will overlook medical school debt and not calculate it into the debt-to-income ratio assessment found in conventional loans. With this exception, a buyer with significant student debt can still buy a house. The physician mortgage loans also allow you to purchase your home 30-90 days before your first day of work, allowing you plenty of time to settle into your new residence. With all of these allowances, however, the physician mortgage loan does require a solid credit score in the 720-740 FICO range.

However, the interest rates for a physician mortgage loan are generally 0.125-0.25% higher than conventional loans, which could end up costing you tens of thousands you could have otherwise invested. While no down payment may seem advantageous, not having the cash to bring to the closing table could signal the need to wait. Qualifying for a higher loan could also tempt you to borrow more than you can afford which may hurt you in the long run.

What you need to know

If you decide to take advantage of a physician mortgage loan, where do you start? Many financial institutions offer this product, so definitely gather information from various banks and credit unions. Start with one you have an existing relationship with; your history and loyalty could work in your favor.

The many years of medical training force young physicians to postpone many goals, so understandably many sign their employment contracts with exhilaration and quickly jump into homeownership. However, even with physician mortgage loans, hitting pause for a bit longer could pay off.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Consider avoiding the temptation to rush a huge life decision—perhaps delay the gratification a little longer until your career has been established and you have had time to build your savings. Evaluate the additional expenses that accompany home ownership (purchasing furniture and appliances, decor, maintenance, repair, insurance, property taxes) and take into account the amount of student debt you already have before deciding to take on a large mortgage. Continuing to rent and living beneath your means can help you feed your savings and increase your net worth in the long run.

A physician mortgage loan opens the door for young doctors to more easily achieve homeownership. If you’re considering buying a home with a physician mortgage loan, first consult with a trusted advisor who specializes in financial planning for physicians to weigh all your options. The advisors at Blankinship & Foster will carefully examine your personal finances and help you determine whether homeownership makes sense at this point in your career.