Quarter in Review

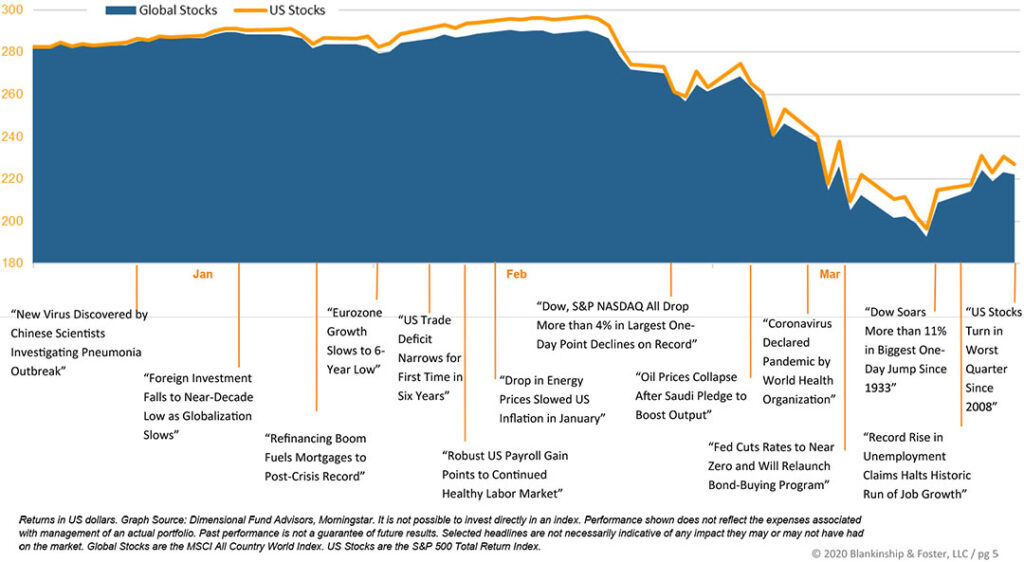

• After reaching all-time highs in February, stock markets plunged rapidly as the severity of the COVID-19 epidemic became clear.

• Overseas and domestically, as trade and travel ground to a halt, so did signs of economic growth.

• Federal fiscal support was approved in both record time and record amounts in an attempt to ease the economic fallout.

During the first week of January, the top stories were the impeachment of the President and deepening tensions with Iran. It was hard to find anyone on Wall Street recommending that investors should sell stocks. Markets were a bit expensive, but optimism ruled supreme following a truce in trade tensions with China. By the end of the quarter, the opposite was true; it became difficult to find anyone looking to buy stocks. Two events shook the market and the economy: the spreading of the coronavirus epidemic outside of mainland China where it began and the price war between Saudi Arabia and Russia, which caused oil prices to plummet from $46 per barrel to around $20 by the end of the quarter.

From its peak on February 19, the S&P 500 Index of large U.S. company stocks dropped 33.5%. Stocks then rose about 15.6% to close the quarter down 19.6%. International stocks fared worse, down about 22.8% for the quarter.

Bonds broadly did their jobs diversifying portfolios and providing stability in a volatile market as the 10-year Treasury bond yield fell from 1.88% to 0.70% by the end of the quarter. That said, some liquidity issues and the rapidity of the decline did cause some disruption in certain segments of the bond market. Corporate bonds fell slightly during the quarter. The Bloomberg Barclay’s U.S. Aggregate Bond Index (representing the entire U.S. bond market) was up 3.2%, while intermediate Treasury bonds were up about 5.3%.

Junk bonds and other alternatives performed poorly during the quarter as default risks (particularly in the heavily indebted energy sector) rose and investors fled to safer income assets. The ICE BofA Corporate High Yield Index lost 13% and Real Estate (REITS) fell 24.4%.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Economy

The quarter began with cautious optimism even as growth had been deceler-ating to around a 2% pace in the fourth quarter. The President’s impeachment acquittal was a foregone conclusion and even rising tensions with Iran failed to dampen economic optimism. That changed with the onset of the coronavirus epidemic as state and local governments implemented social distancing and stay-at-home orders in order to slow the spread of the COVID-19 disease caused by the virus.

The hardest hit industries include retail, hospitality, travel and entertainment, employing a total of approximately 31 million workers. Most of these workers are expected to file for unemployment in the coming weeks, possibly pushing the unemployment rate over 20%, a level not seen since the 1930s. Weekly jobless claims have hit new records, with over sixteen million claims in just three weeks as social distancing and stay-at-home orders shuttered most of these businesses.

The Federal Reserve has reacted with record speed to stabilize markets, pushing interest rates to near zero and taking other steps to support the bond market and lending in general. The Fed has returned to its policy of quantita-tive easing in which they purchase bonds on the open market besides just Treasury bonds. The Fed in recent weeks has virtually promised to buy almost any bond presented to them. This will help free up capital for lending for businesses.

Congress has also reacted with near record speed to assist consumers and businesses, passing over $2 trillion in health care funding, stimulus and economic support measures in the last days of March. To put that into context, Congress authorized roughly $1 trillion in stimulus spending in 2008 and 2009 in response to the Great Financial Crisis and it was more than a year into the crisis before the American Recovery and Reinvestment Act delivered the bulk of the support in 2009. And talk is growing of additional stimulus in the coming weeks. Once these measures are fully enacted, they should help alleviate the economic pain for furloughed workers and affected businesses.

Overseas, some countries have managed to quickly isolate and quarantine infected populations, limiting their economic downside. Others, like Italy and France, have not been so quick or so fortunate. Most of the developed world is facing some level of economic disruption from the pandemic.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Outlook

The question then becomes how quickly we can turn the tide on the virus and how quickly economic activity can return to something resembling normal. On this last point, forecasts and projections are all over the map. A major concern is that reopening businesses too soon can risk a new wave of infections and force governments once again to make difficult choices between public health and economic well-being. There really is no way to know for certain how this will play out.

Rates of infection have already crested in some countries, and the epicenter in China, Hubei province, has largely re-opened with quarantine restrictions lifted. As countries begin to ease restrictions and reopen their economies, the U.S. has the opportunity to observe the initial outcomes of these actions as we are several weeks away from lifting our own restrictions. Current forecasts predict the virus infections to peak in April or early May in most of the U.S., but there’s no telling if or when a second wave might materialize. For exam-ple, the Spanish Flu epidemic lasted for about three years (1918-1920) encompassing three waves of infections.

If we are able to gain control of the outbreak and keep it under control, the economic damage, while significant, will be mitigated somewhat by the actions of Congress and the Federal Reserve. A worst-case scenario would be lifting restrictions too soon, allowing a return of the infection, causing a greater loss of life and a second round of lockdown measures. Federal support will be critical in helping state and local governments cope with the disease while at the same time helping businesses to retain employees and support those who’ve lost their jobs.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Our Portfolios

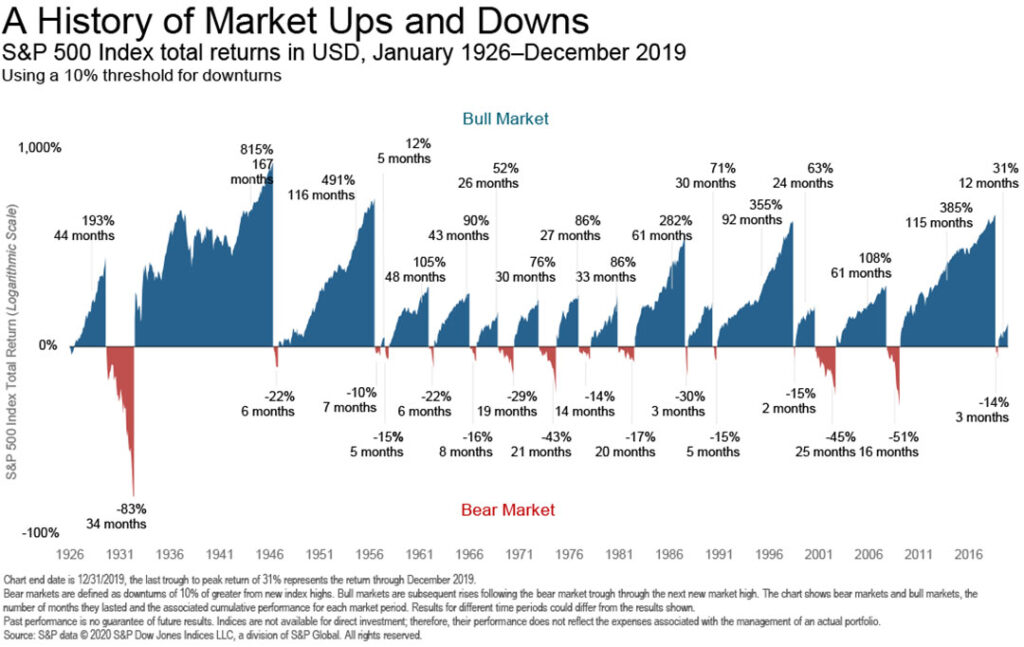

Equity markets frequently experience periods of great dislocation, as the chart on the next pages shows. This is part of investing, and one of the reasons we have built portfolios with different assets that perform differently under these kinds of conditions. As stocks have fallen, bonds have broadly held their value.

We know from past experience that each market drop has different causes, but short of the collapse of the country and our economic system, they often have common results. A sharp drop is usually followed by a brief recovery, and possibly even additional selling. At some point, long before the rest of us feel it is safe to buy stocks, investors will regain their confidence that the worst is past. In every past market sell-off, the stock market has recovered long before the economy did and well before the public was comfortable investing in risky assets.

For this reason, our plan is to hold tight and stick to our portfolio allocations. When values change significantly, we’ll rebalance back to our target allocations, thus buying stocks at cheaper prices. For our clients who are living off the distributions from their portfolios, it can be a very unsettling time. For this reason, we’ve built portfolios with a recognition that retirees should always have a number years of distributions in their bond and cash allocations, allowing them to ride out any stock market volatility.

We know from our experience from past market dislocations that we will get through this one as well. In the meantime, please stay safe and healthy.

We are working remotely, but we are fully operational. As always, we are here for you and we’re ready to provide the guidance and planning you expect from us. if you have any questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.