Quarter in Review

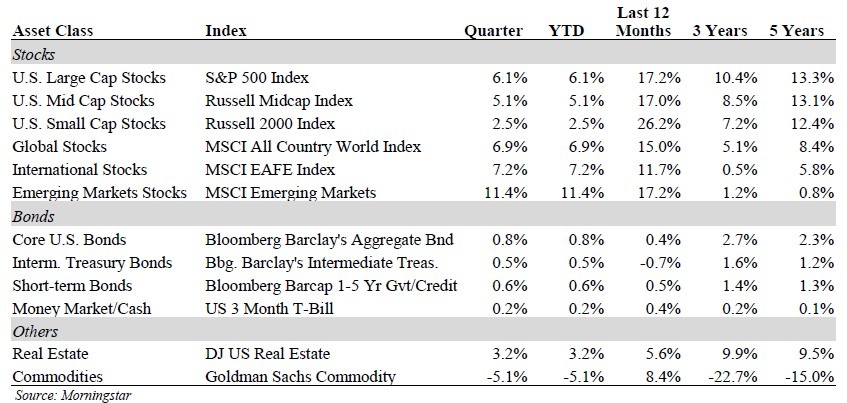

Global stocks continued last quarter’s rally into 2017. The S&P 500 Index of U.S. large company stocks rose 6.1% for the quarter, while smaller company stocks were up by 2.5%. Developed international stocks outperformed U.S. stocks, rising 7.2%, while Emerging Markets stocks soared 11.4% for the quarter.

Despite the Federal Reserve raising interest rates by 0.25%, and expectations for at least two more rate hikes this year, bond returns for the quarter were still fair. The 10-year Treasury Note ended the quarter at 2.40%; almost where it began. As a result, the broad U.S. bond market gained 0.8%. High Yield Bonds did better, rising 2.7% and continuing last year’s outperformance.

Economic Environment

Capital markets broadly benefited from improving global economic conditions. While growth has been generally modest, it has also been better than expected, and we remain cautiously optimistic for 2017. Corporate earnings estimates are being revised higher in both European and emerging-market countries, and sentiment seems to be turning positive, particularly in Europe. At the moment, global recession risk appears low. Taken together, the data we are seeing suggests the investment environment should remain supportive of stocks and other risky assets, at least in the near term. Given this macroeconomic backdrop, we see reasons for optimism the trends that benefited our portfolios in recent quarters can continue.

Global Purchasing Managers Indexes hit multi-year highs across the Eurozone, U.S. and China. Other leading indicators are also positive, and many economic forecasters are fairly optimistic about the global economy in the coming year.

Portfolio Positioning and Outlook

Over the longer term, our analysis continues to indicate the U.S. stock market is broadly overvalued. On several measures the U.S. stock market is as expensive as it has ever been in the past 50 years, aside from the dot-com stock bubble of the late 1990s. The dot-com bubble is instructive because stock valuations rose well past what many observers considered to be extreme levels, until the S&P 500 index ultimately fell nearly 50%. We believe that valuation matters in the long run, but we also recognize that it can take a long time for valuation-driven adjustments to materialize. When stock market valuations are high, the odds of outsized market gains in the future will be low. We remain underweight to U.S. equities in favor of (1) foreign stocks with much better return prospects and (2) select alternative strategies we believe offer attractive returns as well as diversification of risks.

Our portfolios have meaningful exposure to developed international markets. European corporate earnings have barely grown since the 2008–2009 financial crisis, in part due to the regional debt crisis which began in 2011. Fiscal and monetary policies have been insufficient to offset this while U.S. company earnings have grown strongly, exceeding prior cyclical highs. This divergence in earnings trends is the key reason we view international stocks, and European stocks in particular, as more attractive looking forward.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Last year, for the first time since the 2008–2009 financial crisis, Europe’s economy grew faster than that of the United States. Improving economic growth ultimately leads to better sales growth and gets consumers and corporations to borrow and spend. The European Central Bank has revised upward both its inflation and growth projections for 2017–2018. We are seeing equally optimistic indications for Asia as well.

Over the next five years, international companies will likely grow earnings at a much faster rate than their U.S. counterparts, which should lead to outperformance by these stocks. We believe earnings of non-U.S. companies are cyclically depressed, while U.S. earnings are near cyclical highs. We do not believe this condition is ade-quately reflected in their respective valuations.

Emerging-market company earnings are also cyclically depressed relative to earnings of U.S. companies, yet investors are trading at significantly lower valuations. Our research indicates emerging-market stocks in aggregate are trading at a price-to-earnings multiple well below historical averages. As emerging-market earnings growth improves, we expect investors to bid up prices and valuations, generating annualized returns greater than we expect from U.S. or developed international companies.

Our fixed income portfolios remain positioned for rising interest rates. We do not anticipate rapid jumps like we saw following the election last year, but rather a slower progression toward broadly higher interest rates. By overweighting shorter maturity and lower quality (high yield) bonds, we believe we have mitigated some of this risk while providing downside protection in the event of a broad stock market sell-off. This positioning helped our portfolios significantly during the year-end spike in interest rates, and we expect to maintain this positioning for the foreseeable future.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

A Word of Caution

As the economy seems to be gaining momentum, our primary concerns revolve around policy mistakes: acts or failures to act which affect growth, labor markets or consumer spending. Despite a high level of volatility emanating from U.S. politics in recent months, U.S. stock market volatility has remained very low. That is unlikely to last. Our portfolios are prepared for more oscillations, particularly downside risk to U.S. stocks should investors become nervous about the direction of Congressional (fiscal) policy. One challenge facing policymakers in the near-term is the necessity to raise the Federal debt ceiling.

And, of course, global tensions (and again, policy mistakes or miscues) can always intrude to upset and destabilize business activity.

In Conclusion

Our portfolios are positioned to benefit from continued growth while building in some down-side protection. We remain confident in our positioning and in our investment process, both of which allow us to look past periods of uncertainty and keep our focus where it should be: on prudently managing our diversified portfolios to achieve our clients’ long-term objectives.

If you would like to discuss recent market events or have questions specific to your financial situation, please do not hesitate to contact us.

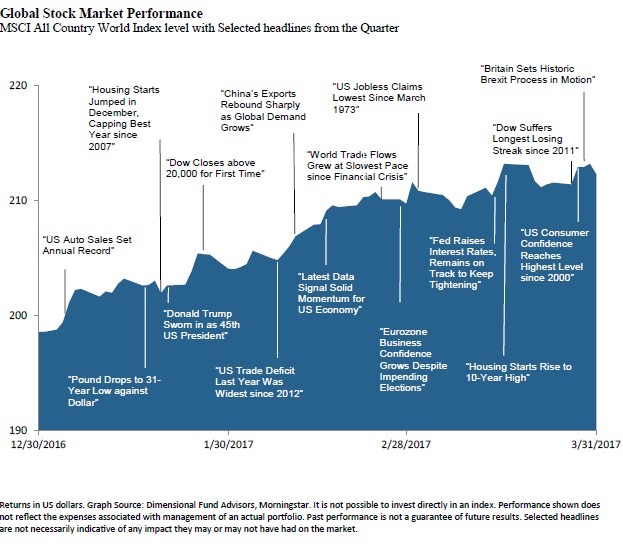

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

Download this First Quarter 2017 Investment Review as a PDF (1.1 MB).

View reports on past quarters here.

.