Quarter in Review

Economic growth in the third quarter looks to have been strong, with the Federal Reserve Bank of Atlanta’s GDP Now forecast running at around 4.9% for the quarter. That indicator has a mixed record, so take that with a grain of salt, but with easing inflation, resilient business investment, and solid consumer spending, the quarter is looking positive. That said, there are signs of slowing momentum as we head into the holiday spending season, and capital markets seem to be having a tough time interpreting the economic crosscurrents. Volatility may be the theme for the rest of the year.

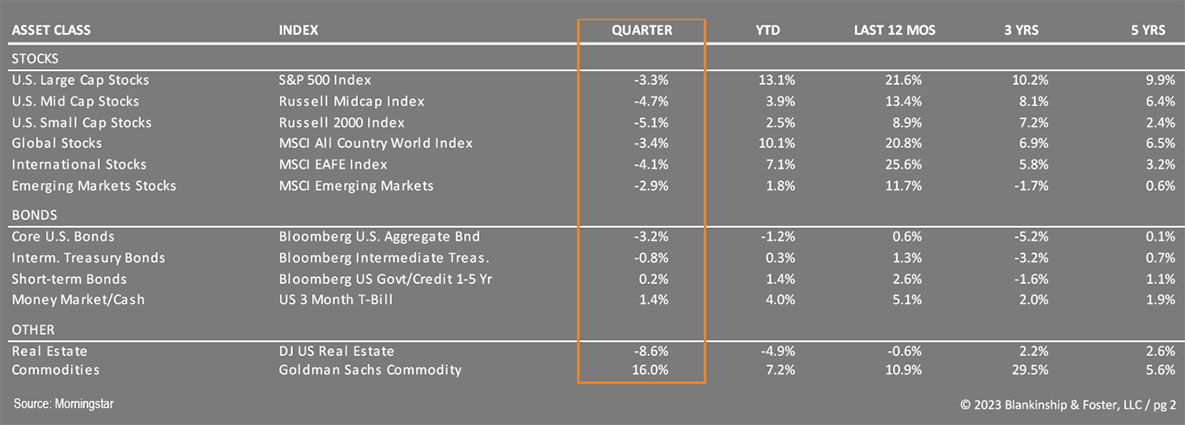

The stock market rally sputtered a bit in the third quarter, with the S&P 500 Index of large U.S. companies falling 3.3% for the quarter, though still up 13.1% year-to-date. The Russell 2000 Index of small company stocks fell 5.1% and is up 2.5% for the year. International stocks, represented by the MSCI EAFE index, fell 4.1% during the quarter on economic weakness in Asia and Europe. The bond market has been volatile, swing between optimism that interest rate hikes were over and acceptance that more were to come. Also, increased selling of Treasury bonds by central banks around the world

(including the Federal Reserve) has put upward pressure on interest rates. The benchmark 10-year Treasury yield ended the third quarter at 4.59%, up considerably from 3.81% on June 30. As a result, the Bloomberg US Aggregate Bond index fell 3.2% during the quarter and is down 1.2% year-to-date. High Yield “junk” bonds held steady at 0.5% for the quarter and up 6.0% for the year. The Dow Jones US Real Estate Index, which tends to be more sensitive to changes in interest rates, dropped 8.6% during the third quarter.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Economy

Gross Domestic Product rose at a 2.1% pace in the second quarter and is likely on track for a stronger result during the third quarter. As noted already, business investment has proved resilient despite tighter lending standards and higher interest rates. It remains to be seen whether companies can maintain high profit margins.

Consumer spending has also remained strong, supported by a tight labor market and real wage growth since 2020. That said, personal savings rates have plummeted while revolving credit has increased. They’re not looking overextended just yet, but delinquencies are starting to rise. Given that it takes about 12-18 months for the full impact of a change in interest rates to flow through the economy, we’re expecting the Federal Reserve’s 18 months of raising interest rates to start taking a bite out of personal consumption, especially when combined with other factors like student loan payments resuming and higher energy prices.

Overall, the economy should continue to grow at a moderate, but slowing pace. Slower growth does make the economy more susceptible to negative shocks, and one prediction model from the Federal Reserve Bank of New York suggests that the probability of a recession twelve months from now is essentially a coin toss.

The labor market has remained remarkably strong, despite rising interest rates. Yet it also shows signs of cooling as the pace of monthly job gains has been trending lower. The participation rate of prime age workers (25 to 54) has fully recovered to pre-pandemic levels, but participation for older workers has not, reflecting baby boomers who have left the workforce permanently. Other labor market indicators suggest that job growth may continue to decelerate in the coming months. Despite the strength in employment, wages broadly have not kept up with rising prices since 2020, so even the 4.5% gain of the past 12 months shouldn’t put upward pressure on inflation. A softening labor market further limits upward pressure on wages heading into next year.

Inflation has cooled since last year. Many of the components that contributed to last year’s price increases have moderated. Prices rose 3.7% year-over-year in August, down from 9.7% in June 2022. Shelter inflation, the largest single contributor to higher prices, has begun to moderate and slowing rent growth should continue to put downward pressure on inflation. Energy prices should also trend lower as we head into the winter, absent an expansion of the current conflict in Israel. We expect headline inflation to decline to around 3% by year end, and possibly back to around 2-2.5% by the end of next year. As a result, the Federal Reserve may be able to stop raising interest rates. The question then becomes how soon they can begin to lower short-term interest rates. This will be driven by how quickly the economy cools, and whether or not we are able to avoid a recession (the proverbial “soft landing”). If a recession does occur, the Fed will be forced to lower interest rates more rapidly.

Overseas, China’s lifting of COVID policies has created somewhat of a rebound in consumer spending, offset by challenges in their real estate sector. In Europe, inflation remains an issue, compounded by weak manufacturing sentiment. India remains a bright spot, as does Japan with improving wage growth after 30 years of weakness. Valuations of overseas equities remain attractive compared to U.S. stocks.

Outlook

The consensus seems to point to a recession beginning sometime in 2024 or 2025, rather than later this year. Investors barely noticed two major shocks at the beginning of this quarter (the ouster of Kevin McCarthy as Speaker of the House and the surprise attacks by Hamas in Israel), suggesting investors are more focused on the Federal Reserve and interest rates.

Looking forward, current valuations on stocks remain somewhat attractive compared to recent history, though growth stock valuations are a bit stretched. Even though stocks have risen this year, bond markets have priced in a fairly significant reduction in interest rates, signaling an expectation of a recession in the coming quarters. We would not be surprised by a drop in stock prices on economic weakness, followed by a strong recovery by the end of 2024, though other scenarios are also possible.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

One thing that is a bit disconcerting is just how narrow the stock market performance has become, meaning that the gains we’re seeing in the indexes are really powered by just a handful of big (mostly tech) companies. This behavior is typically observed late in a bull market. More to the point, it’s nearly impossible to time stock market movements like we’ve described above. For example, historically, periods when consumers feel the worst about the economy have been some of the best times to buy stocks. Equity prices are likely to be volatile this year as investors weigh the impact of a looming (or avoided) recession and negotiations in Washington around funding the government for 2024, among other geopolitical concerns.

Our Portfolios

Our outlook (and hence our portfolio positioning) hasn’t changed materially in the past several weeks. Our stock exposure is currently broad based and weighted towards large U.S. companies. Our value bias, which helped last year as high-flying growth companies struggled with rising interest rates, has been a bit of a detractor this year as investors have shrugged off high interest rates and paid up for the stocks of companies that are showing earnings growth. If a recession does occur, we would expect this trend to reverse again, and those higher P/E (expensive) stocks should fall harder than the rest of the market. Our international exposure remains balanced between hedged and unhedged investments and benefits from more attractive valuations than comparable U.S. equities.

Today’s higher interest rates mean that expected bond returns going forward are more attractive than they were a year ago. More importantly, if our expectation of a recession is realized, interest rates will likely settle back down, providing good returns to bonds should stocks falter heading into a recession. Bonds should be a better diversifier this year, especially if markets are correct in forecasting lower interest rates in 2024. Even if that expectation is unrealized, longer-term interest rates have risen quite a bit already and are unlikely to rise significantly from here.

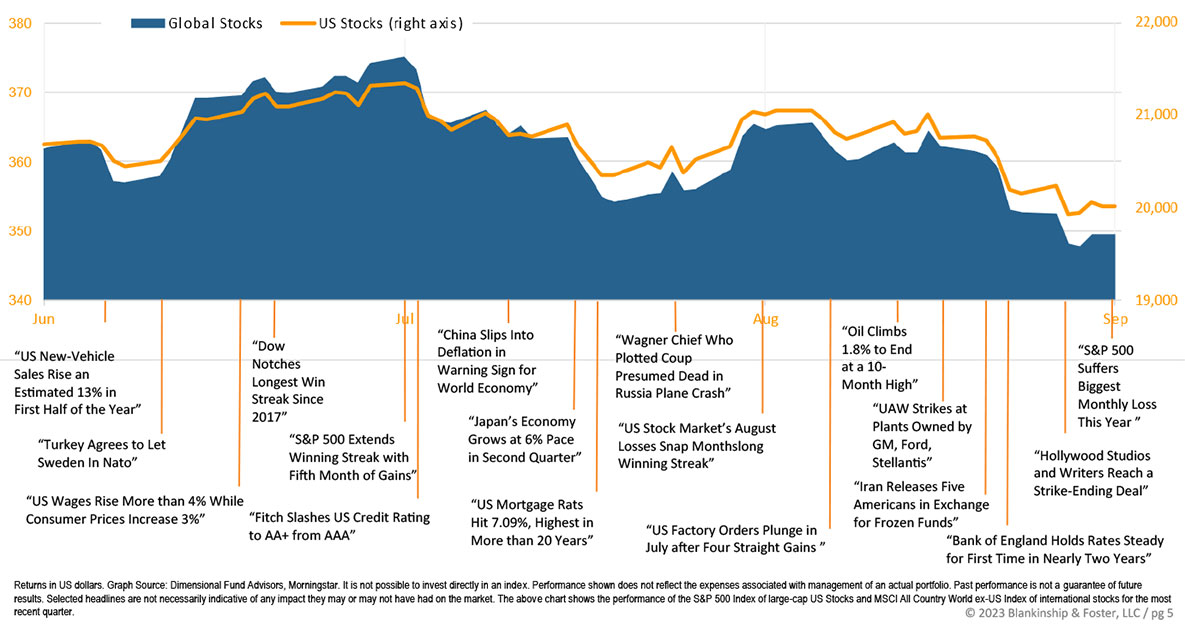

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

In short, we continue to expect volatility as investors prepare for a possible recession and adjust their estimates for stock prices accordingly. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.