The failure of Silicon Valley Bank, Signature Bank, and Silvergate Bank all in the same week rattled investors and financial markets alike. The bank runs and subsequent failures brought back stark reminders of the 2008 financial crisis. Many have been wondering: Is it 2008 all over again?

The 2008 Financial Crisis vs. Now

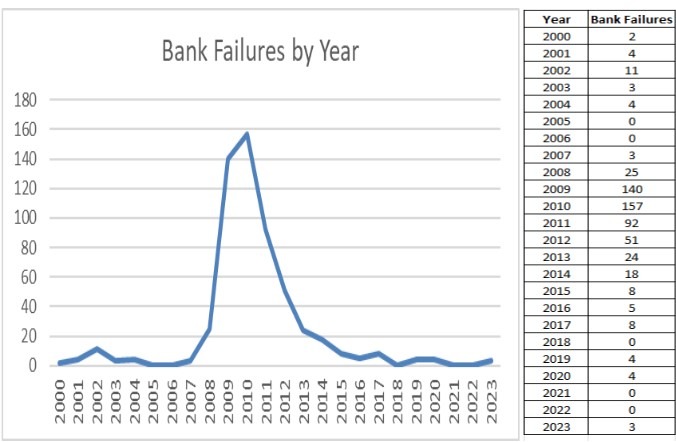

The 2008 financial crisis was the worst since the Great Depression. The causes included bank de-regulation and legislation meant to encourage affordable housing. A real estate bubble ensued, and innovative real estate finance instruments became popular. Banks around the globe gobbled them up, and when the bubble burst, hundreds of banks failed. Most were smaller regional banks, but Washington Mutual’s failure was the biggest in U.S. history.

Following the 2008 financial crisis, major reforms of the banking industry took place. The Wall Street Reform and Consumer Protection Act commanded the Federal Reserve to closely oversee large banks and financial institutions. The regulation of them is tighter, and annual stress tests are required to confirm that they are ready to handle future financial downturns and crises. The small number of bank failures since then is a testament to the effectiveness of these banking reforms.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

The Federal Deposit Insurance System

One of the key defenses against bank failures is the Federal Deposit Insurance Corporation (FDIC). The FDIC is a U.S. government corporation supplying deposit insurance to depositors in American banks. In the event of a bank failure, the FDIC acts in two capacities. First, as the insurer of the bank’s deposits, the FDIC pays insurance to the depositors up to the insurance limit. Second, as the “Receiver” of the failed bank, the FDIC assumes the task of selling/collecting the assets of the failed bank and settling its debts, including claims for deposits in excess of the insured limit.

As it did in the 2008 financial crisis, FDIC acted aggressively in 2023 to calm depositor concerns. One of the main ways that they’ve done this is to guarantee even uninsured deposits at those banks.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

FDIC Insurance limits

The amount of insurance FDIC provides is basically $250,000 per depositor, per bank. However, there are many nuances to this:

- Checking, savings, money market, and CD accounts are combined to determine the amount covered by FDIC insurance. The total of these accounts is insured up to $250,000. So, if you have $150,000 in savings and $150,000 in personal checking at the same bank, you will have $50,000 of uninsured deposits at that bank.

- If you have a joint account with someone, that is separate from your individual accounts. So, you could have up to $250,000 of insurance on your accounts and an additional $250,000 on joint accounts with your spouse.

- Individual retirement accounts (IRAs) are also separated from other accounts, so you can have up to $250,000 on IRAs held at banks.

- Trusts and business accounts get much more complicated. (Revocable) living trusts are insured up to $250,000 for each current beneficiary.

There’s a lot more information and detail on the FDIC website.

To get even more FDIC insurance, there are two networks that banks can access to increase FDIC coverage on CDs and deposit accounts.

- CDARS (Certificate of Deposit Account Registry Service) allows participating banks to spread CD deposits out across multiple banks. Your account at your bank will show each of the CDs you own and the other banks that have been used to ‘spread out’ your deposits.

- ICS (Insured Cash Sweep) is a newer service, similar to CDARS, but for deposit accounts. According to Darlene Mera of CalPrivate Bank, you can insure up to $100,000,000 across roughly 4,000 member banks. Like CDARS, you’ll see the list of banks and the amounts deposited at each on your statement from your bank. One catch is that the interest rate you’ll receive has to be agreed upon by each bank, so it is likely to be lower than market interest rates, representing a cost to access the service.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Additional actions by the Federal Reserve

In addition to the FDIC, the U.S. Federal Reserve has a role in stabilizing the financial system during a bank crisis. In 2023, The Federal Reserve stepped in to make it easier for banks to borrow money in order to return cash to their depositors. This should help stabilize the system in the short run.

Other steps you can take

If you are concerned about the safety of your bank deposits, make sure they are held at an FDIC participating bank. You may want to look at how your accounts are titled, whether you have more than the FDIC insured amount at each bank, and if so, whether your bank offers one of the above-mentioned deposit network services.

Disclosure: The opinions expressed within this blog post are as of the date of publication and are provided for informational purposes only. Content will not be updated after publication and should not be considered current after the publication date. All opinions are subject to change without notice, and due to changes in the market or economic conditions may not necessarily come to pass. Nothing contained herein should be construed as a comprehensive statement of the matters discussed, considered investment, financial, legal, or tax advice, or a recommendation to buy or sell any securities, and no investment decision should be made based solely on any information provided herein. Links to third party content are included for convenience only, we do not endorse, sponsor, or recommend any of the third parties or their websites and do not guarantee the adequacy of information contained within their websites.