Quarter in Review

The Federal Reserve Bank of Atlanta estimates that economic growth accelerated during the second quarter to roughly 7.8%, one of the fastest rates in decades. The U.S. leads most of the world (behind the U.K. and China) in vaccinations and is seeing robust improvement in economic activity, especially in parts of the country that have successful vaccination programs. At the beginning of the third quarter, more than half of the U.S. population have been vaccinated. This has been very important in freeing people to return to something approaching normal.

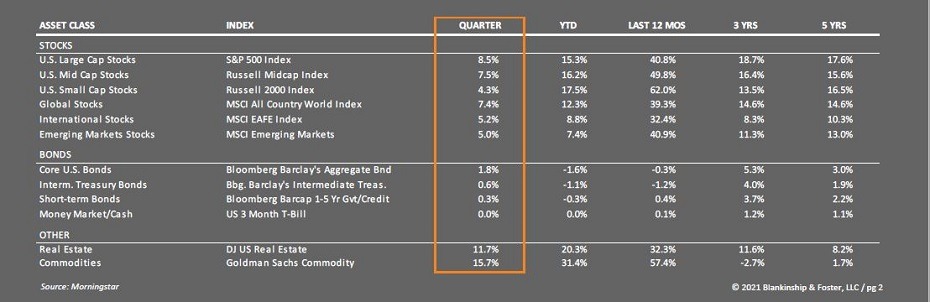

As the U.S. economy continues to surge, large U.S. company stocks, represented by the S&P 500 Index, gained 8.6% during the second quarter while smaller company stocks rose 4.3%. International stocks are up 5.2%. The yield on the 10-year Treasury note fell to 1.45% (when interest rates rise, bond prices fall) and as a result, bonds broadly gained 1.8% for the quarter. Real estate surged 11.7% while high yield (“junk”) bonds were up only 2.7%.

Economy

Besides the vaccination programs discussed above, aggressive fiscal stimulus has also been a powerful force driving economic growth in the second quarter. U.S. economic growth is expected to be about 7% for the year as the $1.9 trillion American Rescue Plan is just beginning to be felt. Indicators in Europe and Asia suggest strong growth overseas as well. Improving vaccination rates and the deployment of stimulus through the EU Fiscal Recovery Fund set the stage for strong growth in the second half of the year. Emerging economies have been harder hit by the virus, and governmental responses have been mixed. Improved vaccine distribution coupled with stronger global demand should spur recovery in these markets.

The surge in U.S. output has also been reflected in a surge in employment. Roughly 14.7 million jobs have been reclaimed since April 2020, or 66% of the 22.2 million jobs lost during the pandemic. Demand for labor is incredibly strong, with roughly as many job openings available as there are unemployed workers. As schools and day care centers fully reopen and special unemployment benefits end in July and September, we should see a reacceleration of job gains, driving employment down to 4-5% by year-end.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

The big question for policy makers is whether the currently tight labor market translates into higher prices that are not ‘transitory’ as the Federal Reserve expects. Wages have been on a steady up-trend since 2012 and are currently growing at roughly 4.6%, the highest rate since the mid-80s. Higher wages could put some pressure on corporate profits, which hit all-time highs in recent reports. The Goldilocks (“just right”) scenario would be a continued climb in corporate revenues, offset slightly by thinning profit margins with stock prices rising modestly. This would help to reduce valuations while still supporting rising stock market prices.

The real issue then becomes inflation. The Consumer Price Index registered a year-over-year change of 5.0% in May 2021, due in large part to supply shortages and a rise in oil prices. Some of these issues are already easing while other supply shortages will ease as the pandemic recedes and global supply chains are repaired. The real risk is that consumers begin to expect higher inflation, which can become something of a self-fulfilling prophecy as they demand higher wages to prepare for higher prices. The Federal Reserve still believes that these pressures will not persist and plans to allow inflation to run a bit high in order to average 2% over the long-run. With inflation having been well below that level for most of the past 10 years, a period of slightly higher inflation is believed to be acceptable. It’s not clear whether inflation will settle back down to the 2% level after 2022, or whether we’ll see sustained price increases higher than that in the future.

Economic growth and inflation have both been higher than expected, causing the Federal Reserve (“Fed”) to begin hinting about raising interest rates sooner than originally planned. While it’s unlikely that will happen in 2021, we should begin to hear more about how the Fed will begin to tighten its monetary policy during the third quarter. Higher long-term inflation could also cause investors to bid up longer-term interest rates. So far, this hasn’t happened to a significant extent, but it remains a possibility if investors become concerned about the sustainability of higher inflation in the long-run. While we don’t expect a rapid rise in interest rates, it remains a risk factor to be observed.

Outlook

Strong economic growth, aggressive fiscal and monetary stimulus, record earnings and improving optimism set the stage for the stock market to continue higher during the second half of the year, although some volatility is to be expected. High valuations make the market more susceptible to negative surprises, so we would not be surprised by some volatility and maybe a correction at some point. But the conditions remain for continued gains both in the U.S. and abroad.

International stocks tend to be more sensitive to the kind of broad-based economic growth we expect in the coming months. When combined with more attractive valuations than U.S. stocks, they remain an attractive asset class, despite the pandemic related challenges in some countries. Stronger growth overseas and the rising U.S. trade deficit should put downward pressure on the dollar, enhancing returns to international investments.

The greatest risk to our positive outlook is a resurgence of the pandemic. New strains are constantly evolving, and a renewed outbreak cannot be ruled out, especially as vaccination rates slow and people become more complacent.

Our Team

As a client of Blankinship & Foster, you have a dedicated team of financial advisors, service and support professionals.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields. Fixed income investors should not expect much from the bond market as gradually rising interest rates and fairly tight credit spreads (the difference between a bond’s yield and the yield on a comparable Treasury bond) mean there is little to be excited about in either Treasury bonds or corporate bonds. Even so, bonds remain attractive shock absorbers when stock market volatility arises, and thus are still an appropriate and meaningful part of a diversified portfolio.

We have also maintained a sizeable portion of our stock exposure in international funds and expect to benefit from decent growth and better valuations as economies begin to recover from the pandemic.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

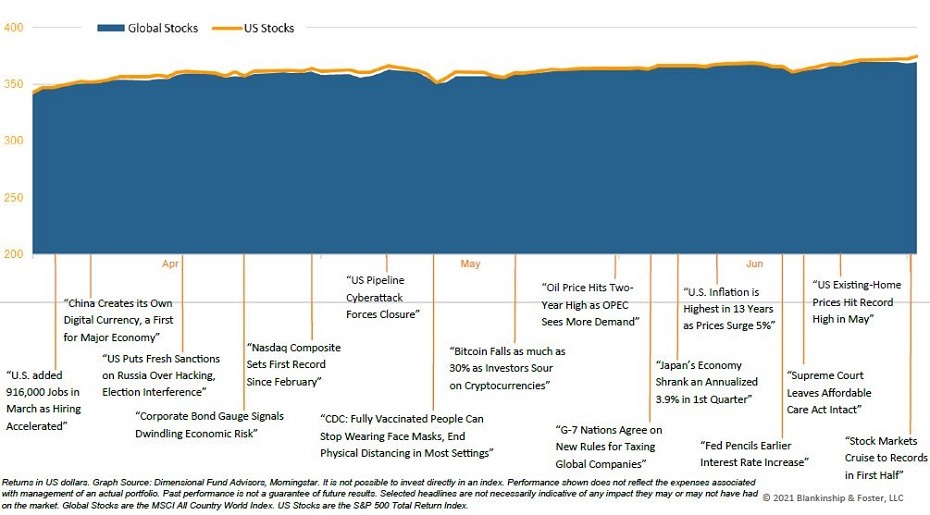

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

DISCLAIMER: Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website.