Quarter In Review

The U.S. stock market continued to rise during the quarter despite signs of slowing economic activity and an increase in trade tensions between the U.S. and China and Mexico. The S&P 500 Index ended the quarter just shy of a record closing high (which it hit on July 1). At the same time, the benchmark 10-year U.S. Treasury bond ended the quarter at the lowest level since 2016: 2.00%.

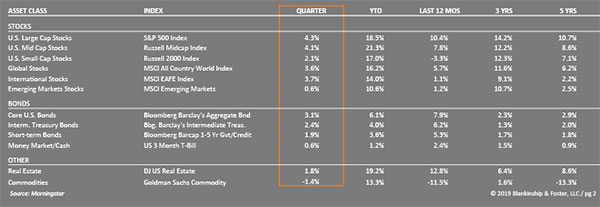

U.S. stocks once again outperformed much of the rest of the world. Large U.S. company stocks gained 4.3% in the first quarter while stocks outside the U.S. gained 3.7%. Smaller U.S. companies, represented by the Russell 2000 Index, rose 2.1%. Diversifying investments like Real Estate Investment Trusts (“REITs”) and pipeline companies (“MLPs”) cooled a bit, up 1.8% and just 0.1%, respectively.

The U.S. fixed income market, represented by the Bloomberg Barclays US Aggregate Bond Index, gained 3.1% as interest rates fell. These ‘Core’ or investment grade bonds outperformed riskier high yield (or junk) bonds, which gained 2.6% for the quarter.

Outlook

The U.S. Treasury yield curve remained inverted throughout much of the quarter, meaning that the yields on longer-maturity bonds were lower than the yields of shorter-maturity bonds. This suggests the bond markets anticipate lower short-term interest rates in the near future, often a sign of looming recession. The conundrum has been the strong performance of stocks as the bond market signals increasing concern about future conditions, though stock market performance often peaks shortly before economic turning points.

As they say on Wall Street, economic expansions don’t die of old age. But they can’t last forever, either. In July, the current expansion entered it’s 10th year since the end of the recession in June 2009. The recent trend in U.S. Gross Domestic Product (GDP) has been around 2% per year. With the fading of stimulus from the 2017 tax bill, economic growth appears set to fall back towards this level in coming quarters. Actually, a large burst of inventory accumulation pushed first quarter growth up to 3.2%, but this often means subsequent growth is subdued as those higher inventories won’t need to be restocked for a while.

GUIDES

The Essential Guide to Retirement Planning

A 4-part series that answers key questions about building your plan, positioning your investments, and more.

Broadly speaking, measures of economic activity around the globe are slowing. The number one reason for this has been the impact of trade tensions and U.S. tariffs targeting imports from most of our trading partners. The weakness however is not isolated to trade-related industries, suggesting a more widespread economic deceleration.

One constant theme this quarter has been the impact of trade policy uncertainty on investment decisions for companies. If management is going to spend billions of dollars building a new factory, they need to have confidence the investment will pay off over the life of the plant. The uncertainty that’s been introduced into America’s trade relationships has made this kind of calculation extremely difficult. The result has been a reduction in corporate investment spending. Similarly, global manufacturing activity has cooled markedly in the past two years on the heals of this uncertainty.

If the economy cools to ‘just’ 1.5 – 2% growth, that’s still expansion, but it also leaves much less margin for error. This global cooling also means that global central banks will be poised to provide additional support through looser monetary policy. The Federal Reserve has already signaled it may cut interest rates later this year, as have European and Asian authorities.

On the Horizon

As we look out over the coming months, several topics loom large. The first is the fast approaching federal debt limit. The federal debt limit is a statute that limits how much money the Treasury Department is allowed to borrow to fund government payments like Social Security checks, payroll, highway funds, etc. With the federal deficit running something close to a trillion dollars this year, there isn’t much room remaining for the government to issue more debt. In fact, the debt limit was officially hit earlier this year, though the Treasury Department has been using all of the tools at its disposal to continue to borrow funds since then. That flexibility runs out shortly. Hitting the debt limit used to cause more angst for investors, but in recent years there has been so much drama (and so little actual impact) around hitting it that markets have barely moved. Still, the possibility exists that Congress fails to enact a new limit (or the President refuses to sign it) resulting in another government shut-down.

Also on the horizon is the possibility of renewed (or escalated) trade tensions if a final deal between the U.S. and China cannot be reached. President Trump has also threatened European countries with sanctions, as well as Mexico. At the moment, these disputes are merely simmering, but the tensions can be reignited with a single tweet. This uncertainty is likely to continue to weigh on markets for the foreseeable future. Two lower probability outcomes are also possible: that the trade tensions boil over into escalating tariffs and reprisals, or that all of the disputes are resolved and the tariffs disappear. This uncertainty takes a bit of the shine off of international equities, but their lower valuations are still very attractive.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

The final variable (after fiscal and trade policy) is interest rates. It seems nearly certain that the Federal Reserve (“Fed”) is preparing to cut the overnight rates in the quarter, but the question remains how often and how much. Investors will be looking for the Fed to support markets with lower interest rates, but low inflation and strong jobs growth makes this difficult to justify. If economic indicators continue to soften (or remain mixed), expect to see lower interest rates in the months ahead.

Our Portfolios

With stocks and bonds both somewhat expensive, and with policy uncertainty lingering, it pays to remain broadly diversified. Our portfolios are positioned to benefit from increasing stock prices while providing some downside protection. We are prepared for slower growth and the possibility of recession.

With global economic growth slowing and the U.S. economy expected to decelerate, investors should expect volatility going forward. Without resolu-tion to some of these concerns, the upside to equity prices is becoming increasingly limited. If Congress enacts some form of stimulus (such as an infrastructure package or increased domestic and defense spending), this could continue to support the markets into next year.

We still view the current environment with cautious optimism, at least for the rest of 2019. As always, if you have specific questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

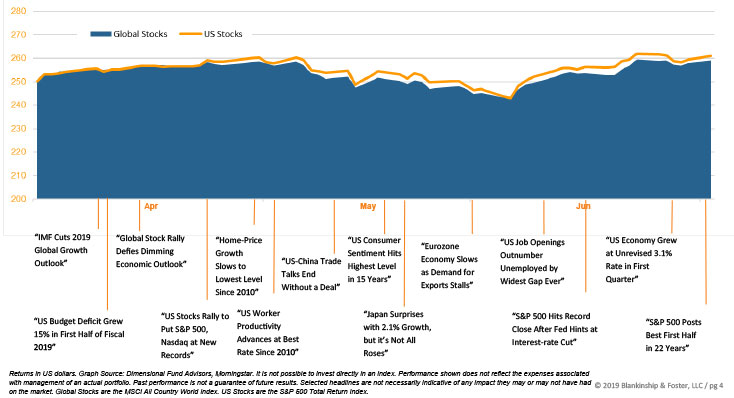

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Download this Second Quarter 2019 Investment Review as a PDF

View other quarters here.