Quarterly Investment Review

At the beginning of the year, there was something of a consensus that a recession was possible sometime during 2023. As it turns out, that was not the case. The economy grew 4.9% in the third quarter alone and is on track for roughly 2.4% growth for the full year, though slowing in 2024 to around 1.5% or so. At the same time, inflation has cooled from 6.4% at the end of 2022 to just 3.3% by the end of 2023. Solid growth with slowing inflation is what the Federal Reserve has been hoping to achieve since they began raising interest rates in early 2022, though the impact of more recent rate hikes has yet to be fully felt. So far, so good.

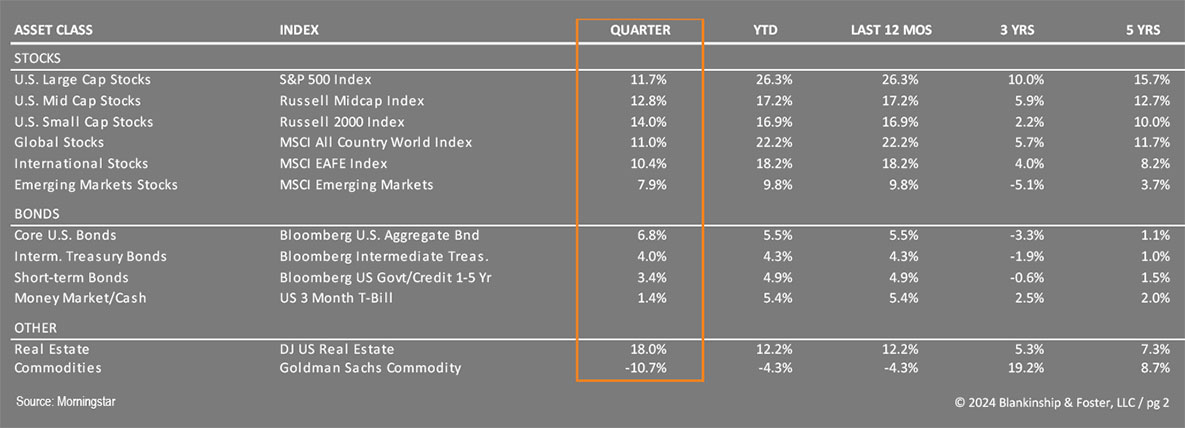

The stock market reversed course and rallied during the fourth quarter, with the S&P 500 Index of large U.S. companies gaining 11.7% for the quarter and 26.3% for the full year. The Russell 2000 Index of small company stocks climbed 14% during the quarter but lagged the S&P at 16.9% for the year. International stocks, represented by the MSCI EAFE index, gained 10.4% during the quarter despite economic weakness in Asia and Europe, and is up 18.2% for the year. The benchmark 10-year Treasury yield ended the year at 3.88%, down from 4.59% at the beginning of the third quarter. As a result, the Barclay’s US Aggregate Bond Index (representing the entire bond market) rose 6.8% during the quarter for a positive 5.5% for the full year. Bond prices rise as interest rates fall. High Yield “junk” bonds gained 13.5% in 2023 while commodities, driven by a significant drop in oil prices, were broadly off 4.3% during the year. The Dow Jones US Real Estate Index rose 12.2% despite concerns about vacancies in most commercial property markets.

Economy

Gross Domestic Product rose at a 4.9% annual pace in the third quarter and is likely on track for an annual gain of about 2.4%. Easing inflation and improved sentiment have helped fuel optimism for a soft landing. Business spending in areas like artificial intelligence and manufacturing held up last year despite tighter lending standards and higher interest rates. Consumer spending has been supported by a tight labor market and rising real (after inflation) wages, especially among the lowest income workers. But there are also signs of weakness. Consumer credit delinquencies are on the rise as are default rates on corporate junk bonds.

Conditions in the labor market are softening. Unemployment remains low at around 3.7%, but workers are quitting jobs at a slower pace while company hiring has also slowed. Wage growth has also eased, suggesting the red-hot labor market of the last couple of years has cooled a bit, potentially putting pressure on consumer spending. This also eases pressure on prices, and barring a recession, unemployment could remain low due to slower labor force growth and steady competition for skilled workers.

Corporate profits were surprisingly robust in 2023, driven by higher revenue as companies raised prices to offset higher costs. Which brings us to inflation. Prices generally rose just 3.3% in December 2023; above the Federal Reserve’s 2% target, but meaningfully lower than the 9.1% peak in June 2022. Looking at the components of inflation, shelter prices (rent) are trending lower, food and energy cost inflation has slowed significantly. If trends continue (and absent a significant external shock), inflation looks set to continue easing in 2024, reducing the likelihood of additional interest rate hikes.

The bond market is currently pricing in several interest rate cuts by the Federal Reserve. While possible, that seems unlikely until further progress is seen on the inflation front. That optimism that the Fed could soon begin to cut short- term interest rates led to a significant drop in Treasury interest rates during the quarter.

Looking around the globe, the Eurozone, Canada, UK and China struggled, while the US, Japan and non-China emerging markets like India did better. China continues to struggle to get back on its feet following the pandemic and some high-profile property and banking challenges while government crackdowns cause unease among global investors. Europe also suffered from weak consumption and business confidence, as evidenced in the Purchasing Manager Indexes. Reforms in India have driven expansion of its middle class and powerful economic growth as a result.

Outlook

The forecasts we read are generally torn between a soft landing (slower growth but no recession) or a mild recession beginning sometime during 2024. In either case, growth is expected to slow during the year, making the economy more susceptible to shocks or policy mistakes like a broader conflict in the Middle East (or Europe) or a prolonged government shutdown in the United States.

If we are able to engineer a soft landing, economic growth would slow enough to tame inflation but not enough to cause a recession, resulting in sustained (but very mild) growth, low unemployment and continued strength in consumer spending. If this happens, the Fed may have to cut rates a bit in order to maintain the momentum, but rates could remain higher for longer. Stocks would also benefit from lower short-term rates but improved confidence and would likely see strong gains.

If a recession occurs, it would likely result in a sharp drop in stock prices and steep cuts in interest rates as well, suggesting bond allocations could offset losses in stock and real estate holdings. While a recession might be mild or short-lived, the volatility would likely be pronounced, especially since so few stocks have contributed to the gains seen in the S&P 500 this past year. According to JP Morgan, 10 stocks make up almost one third of the market capitalization of the S&P 500 index, a record high.

In the fixed income markets, investors are nearly unanimous in expecting lower interest rates, though opinions vary as to the speed or magnitude of the drop. Historically, once the Federal Reserve has stopped raising interest rates (as may be the case), investors tend to have better results in other assets like stocks or bonds, which benefit from a return to lower yields in the future.

Our Portfolios

Our outlook (and hence our portfolio positioning) hasn’t changed materially in the past several weeks. Our stock exposure is currently broad based and weighted towards large U.S. companies. Our small company and value bias, which helped last year as high-flying growth companies struggled with rising interest rates, has been a bit of a detractor this year as investors have shrugged off high interest rates and paid up for the stocks of companies that are showing earnings growth. If a recession does occur, we would expect this trend to reverse again, and those higher P/E (expensive) stocks should fall harder than the rest of the market. Our broad-based portfolios would benefit in this environment. Our international exposure remains balanced between hedged and unhedged investments and benefits from more attractive valuations than comparable U.S. equities.

Today’s higher interest rates mean that expected bond returns going forward are more attractive than they were a year ago. More importantly, if a recession occurs, interest rates will likely settle back down, providing good returns to bonds as stocks falter. Bonds would be better in that event, especially if markets are correct in forecasting lower interest rates ahead.

In short, we continue to expect volatility as investors prepare for a possible recession and adjust their estimates for stock prices accordingly. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

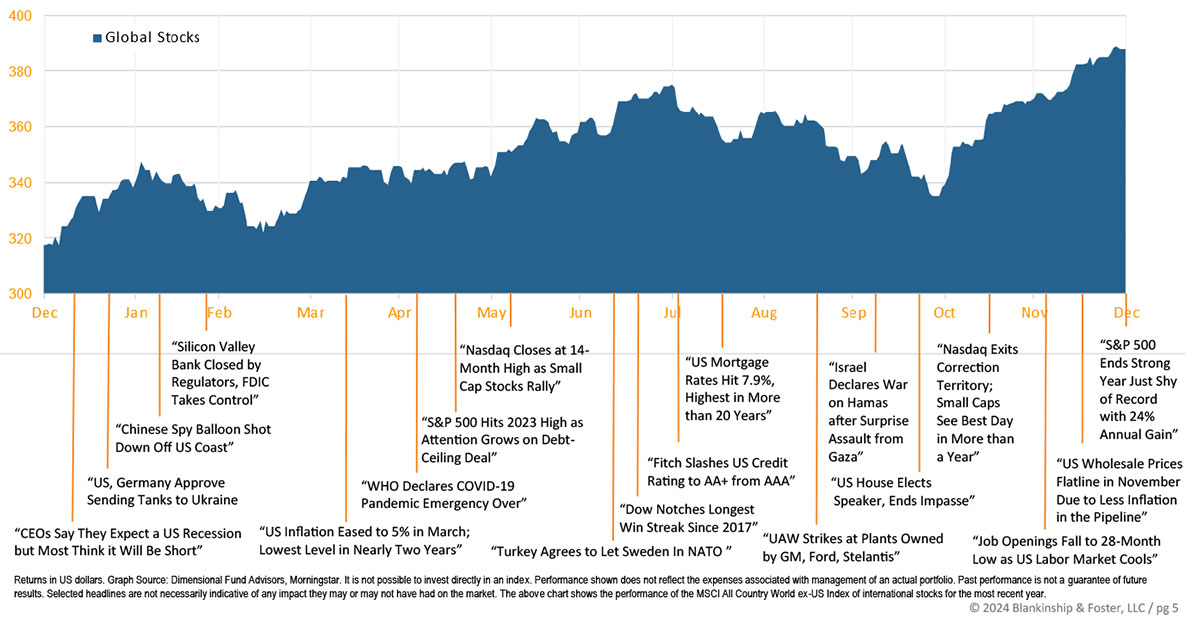

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.