First Quarter 2024 in Review

The U.S. economy has decelerated from the 4.9% rate of growth in the third quarter of 2023 and is on track to expand at a rate of about 2.8% in the first quarter of 2024, according to the GDP Now forecast from the Federal Reserve Bank of Atlanta. Inflation is running a bit higher than the Federal Reserve’s 2% target, or roughly 3.2% year-over-year in February. In addition, the economy added approximately 250,000 jobs per month in 2023 and looks to continue this pace of job creation so far in 2024. As a result, investors have begun to anticipate a relatively good economy in 2024, though the sustained inflation has reduced the possibility of short-term rate cuts and driven up longer-term interest rates modestly.

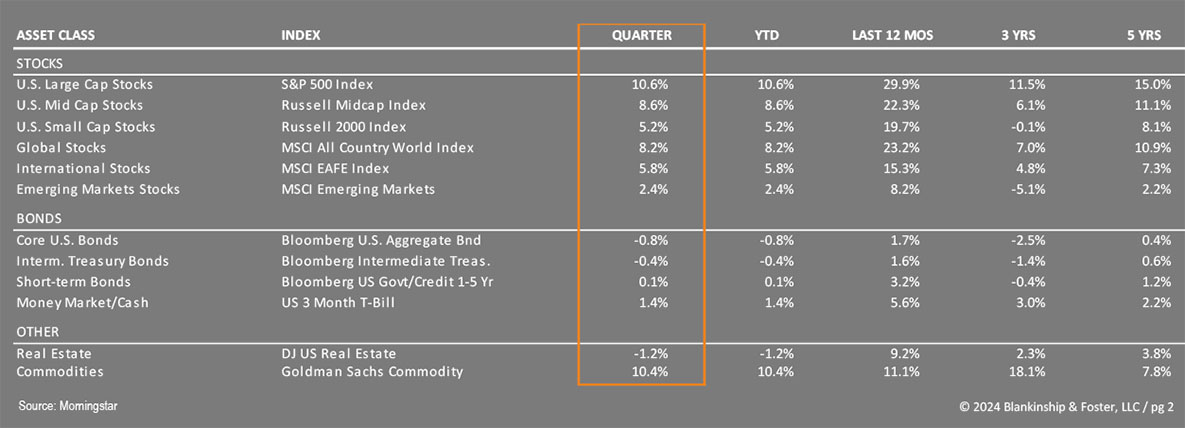

This investor optimism propelled the stock market higher in the first quarter, with the S&P 500 Index of large U.S. companies gaining 10.6% for the first three months of the year. The Russell 2000 Index of small company stocks climbed 5.2%. International stocks, represented by the MSCI EAFE index, gained 5.8% in dollar terms but 10.0% in local currency terms as a rising dollar took a bite out of foreign stock performance during the quarter. The bench- mark 10-year Treasury yield ended the year at 3.88% but rose to 4.33% by April 1. As a result, the Barclay’s US Aggregate Bond Index (representing the entire bond market) fell 0.8% during the quarter (bond prices fall when interest rates rise). High Yield “junk” bonds gained 1.5% while commodities were up 10.4%, driven largely by copper and oil. The Dow Jones US Real Estate Index lost 1.2% as investors fretted over rising interest rates.

Economy

As we’ve written, Gross Domestic Product rose at a 3.4% annual pace in the fourth quarter of 2023 and grew roughly 2.5% during the full year, well above the 2% annual trend since 2000. While decelerating into 2024, the consensus seems to be that the economy is likely to avoid recession, at least in 2024 and is likely on track for an annual gain of about 2.4% for the year.

Consumer spending, which accounts for approximately two-thirds of the U.S. economy, continued to grow last year with only mild cautionary indicators heading into the second quarter of 2024. Auto and credit card delinquencies are rising, though not yet to the levels seen before the 2007 recession, and household debt service (debts as a percent of disposable income) is still below pre-pandemic levels. The labor market remains tight but wage growth has slowed to more normal levels, dampening the pressure on inflation but still supporting modest consumer spending. Corporate profits may come under pressure as lending standards tighten, wages rise and interest rates remain elevated, but even with a slowing (rather than stalling) economy, profits should remain positive.

The labor market remains robust with around 250,000 jobs created every month in 2023 and likely to continue at this pace in 2024. Increased legal immigration has helped to offset what would otherwise create upward pressure on wages (and thus inflation).

On that note, inflation has been hovering the 3.3% mark so far in 2024, chilling investor expectations for interest rate cuts from the Federal Reserve, driven by higher energy prices, housing and services like healthcare and transportation. There is some expectation that a combination of recovered supply chains, new multi-unit housing development and slowing economic growth should continue to put downward pressure on prices. Even so, it now seems unlikely the Fed will cut interest rates before the November election unless something goes seriously wrong. That expectation has pushed the 10- year Treasury back up to around 4.4%, resulting in losses again for bond portfolios and a slight loss of enthusiasm among stock investors.

With a slowing but otherwise strong economy, recession does not seem to be in the cards this year, so any downturn in stock markets should be short-lived, barring some kind of economic or policy shock.

Overseas conditions are something of a mixed bag. China and Europe are looking a bit weak while Japan and non-China emerging markets like India did better. The end of negative real (after-inflation) interest rates in Japan has created optimism there while China continues to struggle to get back on its feet following the pandemic and some high-profile property and banking challenges while government crackdowns cause unease among global investors. Europe also suffered from weak consumption and business confidence, as evidenced in the Purchasing Manager Indexes. Reforms in India have driven expansion of its middle class and powerful economic growth as a result.

Outlook

War in Ukraine. War in the Middle East. Rising oil prices. High housing prices. Inflation is still hovering above 3 percent. Mortgage rates are above 6 percent. And a presidential election that few wanted. It’s said that the stock market often climbs a wall of worry and investors have much to worry about these days.

Growth is expected to slow during the year, making the economy more susceptible to shocks or policy mistakes. But with the prospect of a recession seemingly reduced, stock markets should continue to rise during the year, though perhaps not at last year’s extraordinary pace.

In the soft-landing scenario, economic growth would slow enough to tame inflation but not enough to cause a recession, resulting in sustained (but very mild) growth, low unemployment and continued strength in consumer

spending. If this happens, the Fed may have to cut rates a bit in order to maintain the momentum, but rates could remain higher for longer. Stocks would also benefit from lower short-term rates and improved confidence and would likely see strong gains.

If a recession occurs, it would likely result in a sharp drop in stock prices and steep cuts in interest rates as well, so allocations to fixed income (bonds) should somewhat offset losses in stock and real estate holdings. While a recession might be mild or short-lived, the volatility would likely be pronounced, especially since so few stocks have contributed to the gains seen in the S&P 500 this past year.

In the fixed income markets, investors had priced in six interest rate cuts at the beginning of the year. During the first quarter, interest rates rose as investors recalibrated their expectations to price in three cuts as inflation remains stubbornly above the 3% level. While we don’t expect further increases in interest rates, the Federal Reserve isn’t likely to cut rates until growth or inflation comes down significantly.

Our Portfolios

Our outlook (and hence our portfolio positioning) hasn’t changed materially in the past several weeks. Our stock exposure is currently broad based and weighted towards large U.S. companies. Though we have reduced our exposure to smaller companies, there is still quite a bit in our core market funds so the underperformance there has been a bit of a drag on returns. We are well positioned for economic expansion, but if a recession does occur we would expect our large company stock (and value bias) to hold up somewhat better than the broad stock market. Our international exposure remains balanced between hedged and unhedged investments and benefits from more attractive valuations than comparable U.S. equities.

Today’s higher interest rates mean that expected bond returns going forward are more attractive than they were two years ago. More importantly, if a recession occurs, interest rates will likely settle back down, providing good returns to bonds as stocks falter.

This year, we expect volatility as investors grapple with multiple potential risks and shocks, including the possibility of a recession. We’ll use such periods of volatility to rebalance portfolios and pick up stocks (or bonds) at discounted prices, to better profit from the recovery that has followed every single market decline for as long as there have been markets.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

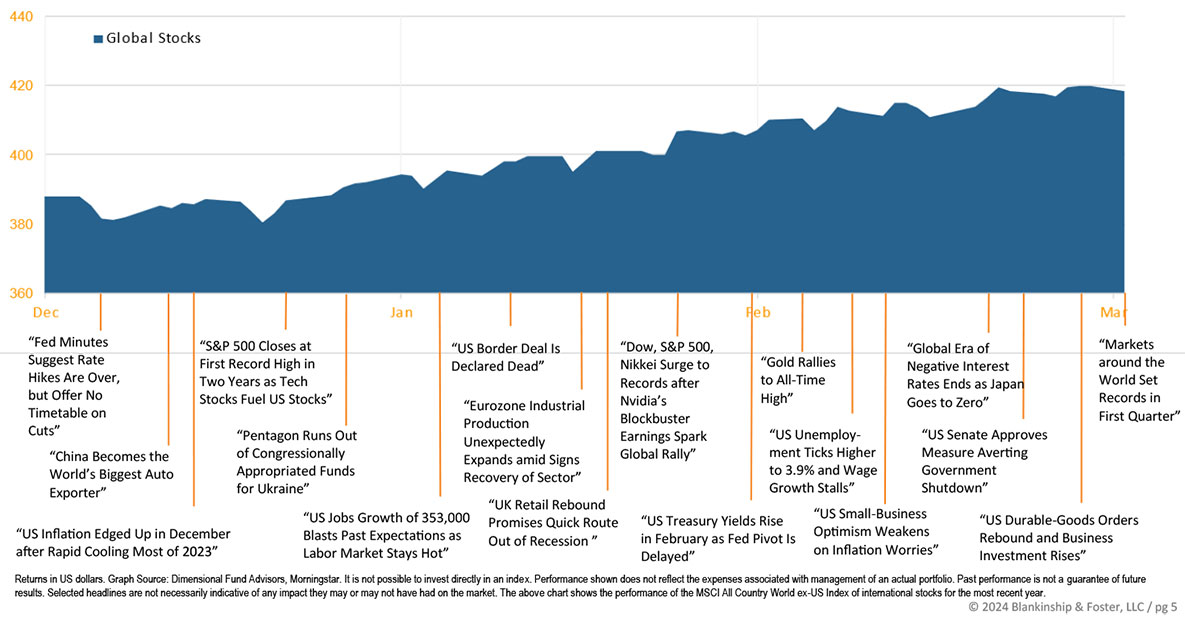

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.