Quarter in Review

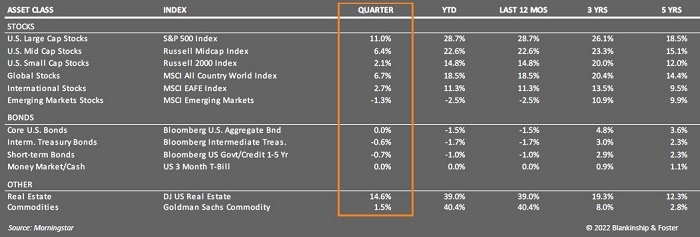

The fourth quarter of 2021 began with expectations for a strong acceleration of economic activity as the wave of COVID Delta variant cases waned. That was offset a bit by the arrival of the Omicron variant which created a mild, though ultimately short-lived sell-off in equities. Stocks rallied into the end of the year despite a slight downshift in economic activity, and the markets managed to finish the year with strong results. The S&P 500 Index of large company U.S. stocks gained 11.0% during the fourth quarter and finished up 28.7% for the year. Smaller company stocks were up 2.1% for the quarter and 14.8% for the year. International stocks also rose, up 2.7% in the fourth quarter and 11.3% in 2021.

The yield on the 10-year Treasury note began 2021 at 0.93% and rose to 1.52% by the end of the year. As a result, the Bloomberg U.S. Aggregate Bond index lost 1.5% (when interest rates rise, bond prices fall). Shorter-maturity bonds held up better, but were still down 1.0% in 2021. High yield (“junk”) bonds benefitted from the improving economy and gained 5.4% for the year.

Economy

As we look at the U.S. economy, the dominant themes are the COVID pandemic, inflation, and a very solid economic recovery. The Omicron variant of COVID has spread like wildfire, and hospitalization rates are spiking across the country as we go to press. During the summer, we saw economic activity slow markedly as the Delta variant swept across the U.S., and Omicron has had a similar impact. While some governments have responded with strong restrictions and even lockdowns (China), the reactions in the U.S. have been more modest, and as a result some of the harsher impacts anticipated by investors have not come to pass.

Global economic growth had been accelerating meaningfully into the fourth quarter of 2021, but you can see the impact of Omicron reflected in high frequency indicators like hotel occupancy, seated diners and TSA traffic. Even so, that means that economic growth will have slowed from torrid to merely heated or from the expected 6-7% annualized rate of growth to ‘merely’ 4-6%. The labor market remains strong and employers cannot find enough workers to meet production, transport and service demands.

This should moderate somewhat in the coming months. The first quarter is usually a time of lower demand for goods and services, allowing manufacturers some breathing room after the busy holiday season to restore supply chains and start to rebuild inventories. Still, bottlenecks remain in shipping and transport, and a strong labor market means that wages have started to press higher, both of which feed into inflation. Energy prices are also well off their pandemic lows, though should moderate in the coming months as supplies and production start to come back online.

The good news is that the economy has recovered beyond its pre-pandemic level of activity. In fact, it has caught up to the pre-pandemic trend (for where economic activity should have been without the interruption). At 3.9%, the unemployment rate is getting close to its pre-pandemic low. Roughly 18.4 million jobs have been recovered since April 2020, or roughly 83% of the 22.4 million jobs lost during the pandemic.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

The economy is expected to begin the year with sturdy growth but settle back to its historical pace of about 2.5% growth by year-end. This is in part because the massive fiscal (congressional spending) and monetary (low interest rates) support that has assisted the economy since March 2020 will largely be removed during 2022. Congress has passed a large infrastructure bill, but that spending will take place over the next 10 years and will only be a fraction of the COVID relief measures passed in 2020 and 2021. The narrowly divided Senate has also become reluctant to increase spending and add more to the federal deficit. The Federal Reserve is set to begin raising short-term interest rates to combat higher inflation, raising the cost of borrowing. The net effect of these two headwinds should be to cool economic growth during 2022, which should also help ease inflationary pressure.

Even so, inflation expectations are running a bit higher than they have been over the past few years since the global financial crisis. The expectation for 2022 is that inflation starts high but settles down to 2-2.5% by the end of the year. This would be higher than pre-pandemic levels, but only slightly.

Outlook

As we enter the third year of the COVID-19 pandemic, we expect the global economic recovery that began last year to continue, though it is likely to moderate due to high energy and food costs, supply chain bottlenecks and tightening credit conditions are all factors. With uneven vaccination rates across rich and poor countries (and even U.S. states), new variants are likely to emerge and could present additional risks to investors.

While the current spike in COVID cases and hospitalizations is alarming (and setting records), data from other countries suggest that the Omicron surge should peak soon and begin to recede. This should boost confidence and consumer activity and may also encourage more skeptical workers to return to the labor force. In any event, Americans have adapted to life in the pandemic, and the lockdowns and restrictions of the first months of the pandemic are unlikely to return.

Corporate profits have surged during the pandemic, and while higher wages and higher supply costs may crimp profit margins a bit, expectations for earnings are still running high. Earnings growth should moderate somewhat but remain strong despite these headwinds. It remains to be seen what impact that will have on stock prices and valuations. As long as profits continue to rise, the stock market could continue its upward climb, even from today’s lofty valuation levels.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

High valuations make the market more susceptible to negative surprises, so volatility and possibly even a significant correction are to be expected. But the conditions remain for continued gains both in the U.S. and abroad. International stocks tend to be more sensitive to the kind of broad-based economic growth we expect in the coming months as conditions improve. When combined with more attractive valuations than U.S. stocks, international stocks remain an attractive investment. Stronger growth overseas and the rising U.S. trade deficit should put downward pressure on the dollar, further enhancing returns to international investments.

The greatest risks to our constructive outlook are a resurgence of the pandemic and continued high inflation. New strains are constantly evolving, and a renewed outbreak cannot be ruled out, especially as vaccination rates slow and people become more complacent. Inflation is expected to moderate during the year, but if it does not, the Federal Reserve may be tempted to act more aggressively, raising the risks of a sharper slow-down in economic activity. Geopolitical risk is a constant, and it’s unlikely relations with China will improve any time soon. A shooting war in Ukraine is a possibility, but the impact on capital markets should be limited.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far given the fiscal and monetary support over the last two years. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields. Returns for bonds will be paltry as interest rates continue to rise. Even so, bonds remain important shock absorbers when stock market volatility arises, and thus are still an appropriate and meaningful part of a diversified portfolio. Our inflation protection comes mainly from equity exposure.

As we have said, our portfolios include allocations to international stocks, which should benefit from improving growth and better valuations as economies continue to recover from the pandemic. Growth overseas will be uneven and choppy, but should provide attractive diversification and decent returns for U.S. investors.

As always, we are here for you and are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Going Green

We have been working with our technology vendors and are excited to announce that we are able to deliver your quarterly reports to you via our secure online portal. This will help to save paper and is actually more secure, since you can only access the reports through a secure internet connection.

If you would like to save a few trees (and make the reports available whenever you’re ready to read them), then please email your advisor and ask about converting your reports to electronic delivery.

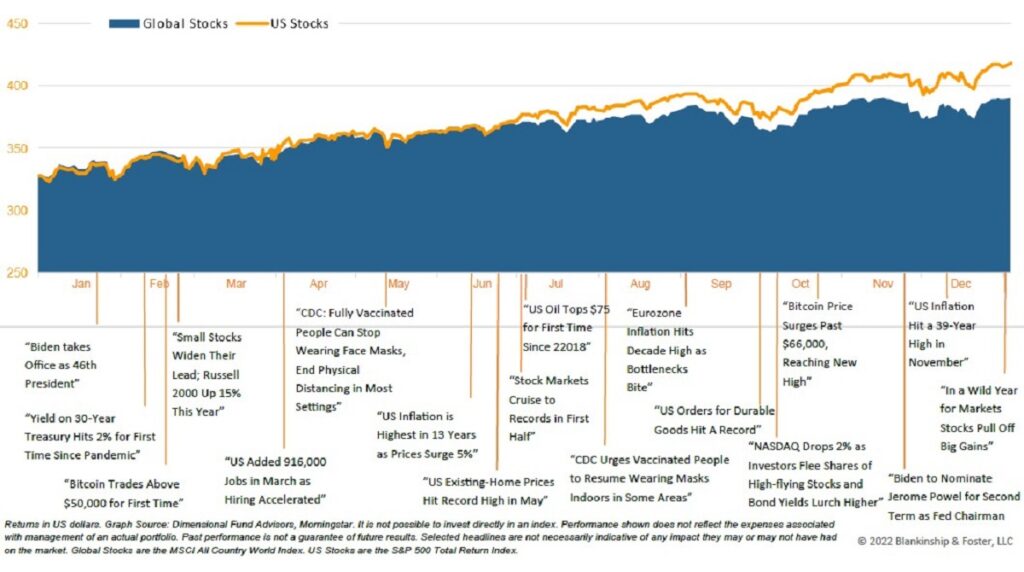

Global Stock Market Performance

The chart above shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

DISCLOSURE: Past performance is not an indication of future returns. Information and opinions provided herein reflect the views of the author as of the publication date of this article. Such views and opinions are subject to change at any point and without notice. Some of the information provided herein was obtained from third-party sources believed to be reliable but such information is not guaranteed to be accurate.

The content is being provided for informational purposes only, and nothing within is, or is intended to constitute, investment, tax, or legal advice or a recommendation to buy or sell any types of securities or investments. The author has not considered the investment objectives, financial situation, or particular needs of any individual investor. Any forward-looking statements or forecasts are based on assumptions only, and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Any assumptions and projections displayed are estimates, hypothetical in nature, and meant to serve solely as a guideline. No investment decision should be made based solely on any information provided herein.

There is a risk of loss from an investment in securities, including the risk of total loss of principal, which an investor will need to be prepared to bear. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance.

Blankinship & Foster is an investment adviser registered with the Securities & Exchange Commission (SEC). However, such registration does not imply a certain level of skill or training and no inference to the contrary should be made. Complete information about our services and fees is contained in our Form ADV Part 2A (Disclosure Brochure), a copy of which can be obtained at www.adviserinfo.sec.gov or by calling us at (858) 755-5166, or by visiting our website at www.bfadvisors.com.