4-part series answering key questions about building your plan, positioning your investments, and more.

You’ve worked hard to get to this point. With our guidance, you’ll stay on top of the issues that affect your finances and your life.

We take great pride and satisfaction in helping people like you navigate life’s journey with sound, objective advice. We’re here to help you make the right financial decisions at the right times.

4-part series answering key questions about building your plan, positioning your investments, and more.

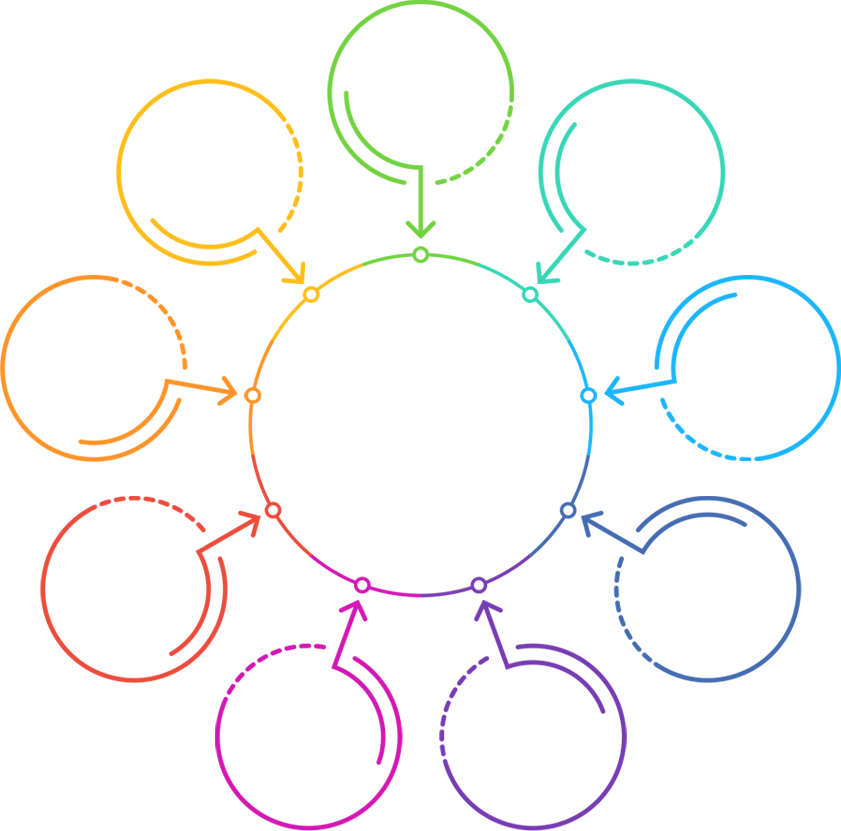

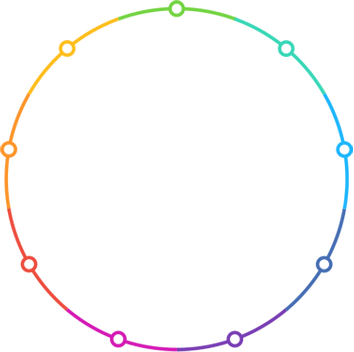

Managing your retirement requires a deeper look at all the areas of your life to make interconnected financial decisions. We’ll guide you toward building your integrated strategy, in manageable, “bite-sized” steps.

YOUR GOALS AND WHAT IS IMPORTANT TO YOU

YOUR GOALS AND WHAT IS IMPORTANT TO YOU

ASSET AND LIABILITY PLANNING

ASSET AND LIABILITY PLANNING

RETIREMENT INCOME AND CASH FLOW PLANNING

RETIREMENT INCOME AND CASH FLOW PLANNING

BENEFITS, SOCIAL SECURITY AND MEDICARE PLANNING

BENEFITS, SOCIAL SECURITY AND MEDICARE PLANNING

INVESTMENT PORTFOLIO DESIGN AND MANAGEMENT

INVESTMENT PORTFOLIO DESIGN AND MANAGEMENT

LEGACY AND GENERATIONAL PLANNING

LEGACY AND GENERATIONAL PLANNING

RISK PROTECTION PLANNING

RISK PROTECTION PLANNING

LONGEVITY AND ESTATE PLANNING

LONGEVITY AND ESTATE PLANNING

INCOME TAX PLANNING

INCOME TAX PLANNING

Once we’ve worked together to develop a sound financial strategy, we’ll help you put your plans into place. Together we’ll maintain and adjust your planning so you can relax and enjoy the ride.

Even with the best planning in place, unexpected events sometimes occur; they often come with emotions that could cloud judgment. Our goal is to help guide you through tumultuous times by providing financial advice and support throughout situations such as:

With a financial advisor who knows you — really knows you — you will be empowered with the confidence in your choices and the peace of mind that comes from knowing you’re prepared for whatever life brings your way.