Quarter in Review

It may not have felt like it, but the U.S. stock market ended the third quarter 1.2% higher than it began.

• Slowing global economic activity, mixed U.S. economic data and the volatile trade situation all weighed on investor (and business) sentiment. Investors largely continue to tune out the daily ups and downs (and tantrums) in Washington as just background noise.

• Recession does not appear to be an immediate risk, but recession is closer as we begin the tenth year of this record economic expansion.

• Returns across most asset classes were generally muted as investors wait for (trade, fiscal and monetary) policy clarity.

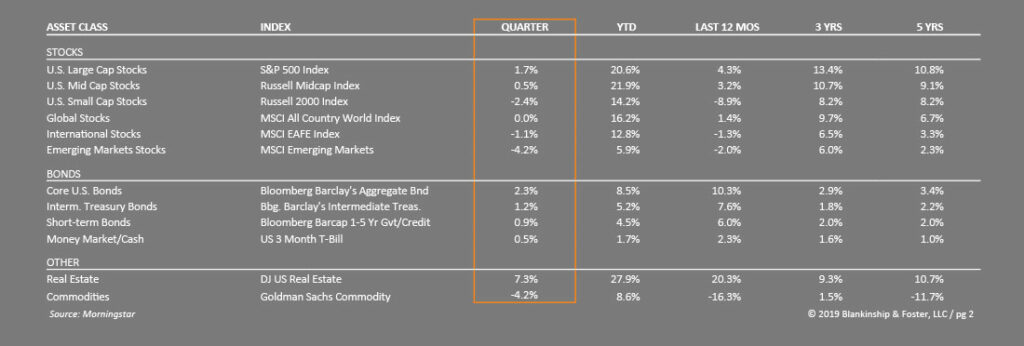

U.S. stocks once again outperformed much of the rest of the world. While large U.S. company stocks posted gains, small company stocks, represented by the Russell 2000 Index, lost 2.4%. Companies in developed countries outside the U.S. shed 1.1% while emerging markets stocks lost 4.2%. The U.S. fixed income market, represented by the Bloomberg Barclays US Aggregate Bond Index, gained 2.3% as interest rates continued to fall from the second quarter. These ‘core’ or investment grade bonds outperformed riskier high yield (or junk) bonds, which gained only 1.3% for the quarter.

Economy

The U.S. economy, while still strong and growing, is showing signs of slowing down. After a record-breaking ten years of expansion, a slowdown and eventual recession is to be expected. While the timing of a recession is unclear, the slowdown in growth means there’s less margin for error in making important policy decisions.

Here, an analogy of flying a plane comes in handy. A plane needs to travel fast enough to stay in the air. The point where the plane is travelling too slowly to fly is called the “stall speed”. When a plane gets too close to its stall speed, minor pilot errors can bring on a stall, making conditions a lot worse. The economy today is slowing down, getting closer to stall speed.

Economic data during the quarter have been something of a mixed bag. The economy grew at a 2.3% pace during the second quarter, and estimates are suggesting that it could slow even more in the third quarter. Manufacturing in the U.S. contracted during the quarter, while the service side of the economy has flattened. Major economies around the world are dangerously close to recession, including Germany and the United Kingdom. Global trade activity is shrinking, largely as a result of U.S. tariffs and threats of tariffs.

While U.S. consumer spending remains solid, the greatest problem is business confidence, greatly impacted by the variability in trade policy coming from Washington. If businesses don’t know what the rules are going to be (and thus the costs of their operations), they will usually delay investments until abso-lutely necessary or until some clarity returns. In the current environment, the volatile trade policy has had a devastating impact on business investment. This hasn’t spilled over into hiring yet, but there has been an impact on investment in plants and equipment. As business leaders become more cautious in their outlook, they tend to delay hiring as well as construction, which would begin to weigh more heavily on the rest of the economy.

Thus the key to whether or not we have a recession in the U.S. is likely to be whether or not businesses can gain some kind of clarity or stability in trade and economic policy. While the rest of the drama in Washington is largely background noise, companies are paying very close attention to the back-and-forth over trade policy with China, Mexico, Canada and the European Union.

As a result of the uncertainty surrounding trade policy, long-term interest rates fell during the quarter, though began to rebound in September. The U.S. Treasury yield curve remained inverted throughout much of the quarter, meaning that the yields on longer-maturity bonds were lower than the yields of shorter-maturity bonds. The Federal Reserve (“Fed”) cut the overnight interest rate twice during the quarter in a move described as something of an insurance policy (trying to get ahead of slowing growth). Bond investors expect one more cut before the end of the year.

Outlook

At this time, a recession in the near-term is not our base case scenario, but it has become more likely. A scenario of weak economic growth where the unemployment rate holds steady at about 3.5-3.7% seems to be the most likely outcome at this point.

In our view, the most important factor in global and U.S. growth is the trade tensions between the U.S. and China. A comprehensive trade deal that re-moves many of the tariffs could produce a synchronized global rebound that would boost asset prices worldwide. On the other hand, an escalation of these tensions would almost certainly tip an already slowing global economy into recession. That said, our base case is that some modest trade deals may be possible, but that these tensions remain on a low boil for the foreseeable future.

Global central banks (including the Fed) appear poised to lower interest rates and apply other forms of monetary easing. Fiscal stimulus (tax cuts or govern-ment spending) could also provide a boost. These could provide some support for continued gains in equity prices, at least in the near-term. However, at this stage there doesn’t seem to be much impact from Fed interest rate movements and little likelihood of Congress providing funding for a significant increase in government spending required to stimulate the economy.

A slow slide into recession need not be catastrophic for stock markets, but it won’t be beneficial, either. We can envision a mild recession with a modest pull-back in prices, followed by acceleration within a few quarters.

Our Portfolios

With stocks and bonds both somewhat expensive, but policy uncertainty lingering, it pays to remain broadly diversified. Our portfolios are positioned to benefit from increasing stock prices while providing downside protection. We are prepared for slower growth and the possibility of recession.

Our clients should be prepared for volatility going forward. Without resolution to some of the risks we identified, the upside to equity prices is becoming increasingly limited. We still view the current environment with cautious optimism, at least for the rest of this year.

As always, if you have specific questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

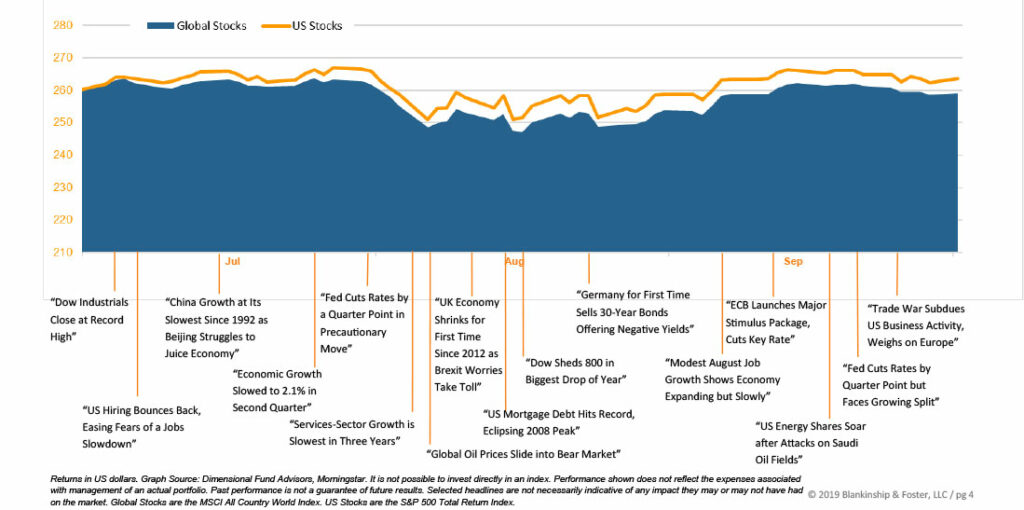

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.