Quarter In Review

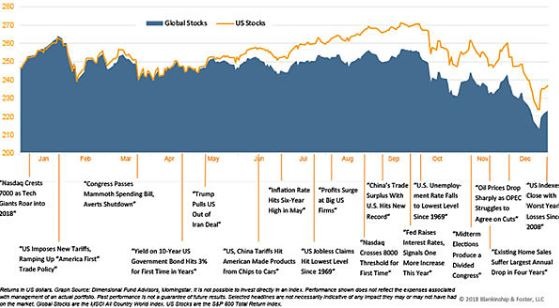

After logging strong returns in 2017, global equity markets turned negative in 2018. Investors had a lot to digest as headlines throughout 2018 included conflicting reports on slowing global economic growth, record U.S. corporate earnings, record low unemployment in the U.S., trade tensions with China, interest rate uncertainties, and the implementation of Brexit.

Global equity markets declined in the fourth quarter. Large U.S. company stocks fell 13.5% in the fourth quarter while stocks outside the U.S. were down 12.8%. As a result, the S&P 500 shed 4.4% for the year and the MSCI All Country World Index dropped 9.4% for the year.

At the same time, the return on the U.S. fixed income market was relatively flat; the Bloomberg Barclays U.S. Aggregate Bond Index returned 0.0%. The ‘benchmark’ 10-year Treasury bond yield rose from 2.46% to a high of about 3.25% before falling back to 2.69% by year-end. Credit spreads, which are the difference between yields on lower quality and higher quality fixed income securities, broadly widened during the year. This means that investors were demanding higher yields to take on the higher risk of default for lower quality bonds.

Outlook

With the yield curve signaling higher risk at the end of the quarter, there were basically four themes that were bothering investors, three of which have since been mitigated.

The first concern was that global economic cooling could impact the U.S. economy. The economy is still growing, and the first statistics received in January confirmed the U.S. is still in pretty good shape. The strong jobs report, with improved wage growth, combined with other statistics, were very reassuring.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Generally speaking, recessions typically begin as a result of one of three things: massive external shocks, some kind of systemic financial breakdown or overdevelopment in a particular part of the economy. We can’t predict when or how external shocks will happen, but that’s always a possibility. The finan-cial system is in much better shape than it was 10 years ago, with significantly less leverage on bank and personal balance sheets. Looking at the parts of the economy that have been responsible for recessions in the past (autos, resi-dential investment, business investment and inventories), none are particularly overbuilt at this time.

The second thing bothering investors at year-end was the Federal Reserve’s (“Fed”) apparent intent to keep raising interest rates despite slowing growth. In the U.S., the yield curve flattened during the quarter as interest rates increased more on the short end of the yield curve than the long end. The yield on the 3-month U.S. Treasury bill increased 1.06% to end the year at 2.45% while the yield on the 10-year U.S. Treasury note increased just 0.29% during the year to end at 2.69%. At the end of the year, the yield on the 2, 3, 5, and 7-year Treasury bonds were all lower than the yield on the 1-year bond, suggesting the markets anticipate slower growth ahead. It also implies a higher risk of recession in the next few years, but that’s not guaranteed.

With the yield curve signaling caution, investors were relieved when Jay Powell, the Fed Chairman, recently made it clear that the Fed would be careful about looking at the data first. Investors interpreted this as a pause in the steady path upward in interest rates, reliving their third concern.

The third concern for investors at year-end was a combination of weakness in the Chinese economy and little progress on cooling the trade tensions be-tween the U.S. and China. It is not helpful for either country to have trade tensions ramping up while both economies are slowing. As we go to press, there have been some encouraging developments, though we’ll have to see where discussions go in the coming months.

Finally, investors have largely ignored the government shutdown, but the longer it goes on, the more it will bother Wall Street.

One quick side note about declines like the one we saw in the fourth quarter. Equity market declines of 10% have occurred numerous times in the past. After declines of 10% or more, equity returns over the subsequent 12 months have been positive 71% of the time in U.S. markets and 72% of the time in other developed markets. If this pattern holds true, it would be good news for investors.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

Our Portfolios

2018 was not a good year for balanced portfolios. Bonds outperformed stocks, but only because they didn’t lose money. Some alternative asset classes did okay, but just about anything exposed to international trade or emerging markets suffered. Looking ahead, our portfolios are well positioned to benefit from a recovery in stock prices as investors regain confidence. We are also prepared for slowing growth (which suggests interest rates may either stabilize or come down a bit) and the possibility of recession.

With global economic growth slowing and the U.S. economy expected to decelerate, investors should not expect the kinds of high gains we saw in 2017. In fact, 2017 was an anomaly: the lowest stock market volatility in the past 50 years combined with one of the highest annual returns. 2018 was much more ‘normal’ in that regard. We expect higher volatility to continue as investors try to gauge the trajectory of growth, inflation, interest rates and trade policy in the coming months.

Looking overseas, equity valuations are extremely compelling. Thus we main-tain our allocation to international investments to take advantage of the opportunity the attractive valuations present.

In short, we view the current environment with cautious optimism, at least for this year. Our portfolios are positioned somewhat conservatively, preparing for difficult times ahead. Since nobody can reliably predict when a recession might begin (or when the stock market might sell off ahead of that event), we balance our risks and opportunities to make the best of the conditions present today.

As always, if you have any specific questions about your investments or your portfolio, we’d love the opportunity to discuss them with you.

Global Stock Market Performance

The chart shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.

Download this Fourth Quarter 2018 Investment Review as a PDF

View reports on past quarters here.