Quarter in Review

2020 is a year for the history books. As COVID-19 killed more than 341,000 Americans, the economy tanked in the first half of the year and has made an impressive comeback during the second half. Stock markets reached all-time highs during the year, both before and after the pandemic struck.

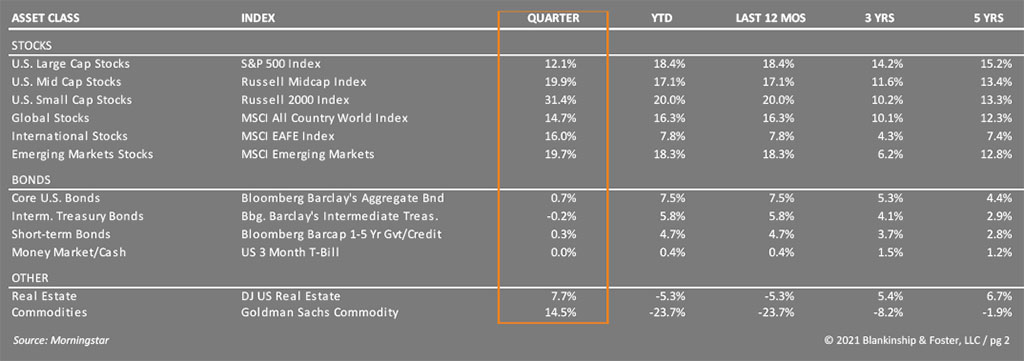

In the fourth quarter, Large U.S. company stocks, represented by the S&P 500 Index, gained 12.1% during the quarter, ending the year 18.4% higher than 2019. Smaller company stocks surged 31.4%, rising 20.0% for the year. International stocks gained 16.0% during the quarter and are up 7.8% for the year. The yield on the 10-year Treasury note rose from 0.69% to 0.93% (when interest rates rise, bond prices fall) and as a result, the bond market earned just 0.7% for the quarter, though providing a solid 7.5% return for the year. In aggregate, it was a volatile but very profitable year for capital markets.

Economy

The same could not be said for the economy. Of the 22 million Americans who lost their jobs early in 2020, almost 9 million were still unemployed by the end of the year, an unemployment rate of 6.7%. U.S. Gross Domestic Product, the sum total of goods and services produced in the United States, ended 2019 at $21.7 trillion and is unlikely to reach that mark again as of the end of the year. Growth in the first quarter is expected to stall as the COVID infection surge has forced localized lockdowns to attempt to control the spread of the virus.

One bright note is the approval in December of two vaccines for use in the U.S. It’s estimated that between 100-200 million Americans may be vaccinated by the middle of the year, hopefully allowing life to return to some semblance of normal. In addition, Congress passed additional COVID relief in December and is expected to pass additional funding later in January. This combination of aggressive fiscal stimulus, low interest rates and improving health conditions is expected to stimulate strong growth in the economy in mid-2021 and into 2022. The Wall Street Journal’s survey of economic forecasters shows average expected growth in 2021 at 3.7%, following a lull in activity in the first quarter.

ACCREDITATIONS & AWARDS

We’re proud to have been honored by some of the organizations in our industry.

Our view remains that the economy will not fully recover until the pandemic is under control, but with the approval of the vaccines, that goal is now in sight. The question then becomes “what happens next?” The strong performance of smaller company stocks suggests that investors are expecting a broad economic recovery, and we tend to agree with this assessment. Growth has accelerated in many emerging and foreign economies, and industrial production is ramping up to make up for supply chain disruptions earlier in the year. Unlike the 2008 recession which destroyed family finances, most households are coming through 2020’s recession in relatively good shape. There are those who have been impacted of course, but many Americans have been able to save their stimulus checks and are awaiting an opportunity to spend them.

Even so, it will likely be a couple of years before unemployment returns to pre-pandemic levels. As a result, the Federal Reserve’s new policy guidance suggests they will keep interest rates very low for a very long time, possibly even until we hit the 4% unemployment mark. Investor expectations are for the overnight Fed Funds rate to remain at or near 0% well into 2022 if not beyond, while longer-term interest rates may rise as the economy recovers.

In the coming year, these conditions (low interest rates and accelerating economic activity) will likely raise fears of inflation. Comparisons to early 2020 when prices were falling will make it appear as if there is higher inflation in the system than may actually exist. The Federal Reserve’s goal is to see sustained inflation above 2% for an extended period in order to make up for a lower level of inflation during the recession. The market is currently suggesting we won’t see much more than their 2% target any time soon.

Outlook

With strong growth and improving optimism, corporate profits should hit records again in 2021. Low inflation, low interest rates and robust fiscal stimulus are a good foundation for continued stock market returns despite high valuations. Since this scenario seems to be priced into stock markets, any disappointment could negatively impact stock prices. We would not be surprised to see some kind of a pullback in stock prices, but with all the stimulus in the system, any such period of weakness is not likely to last. A challenge for equity investors is the increasing concentration of gains in relatively few stocks. The largest 10 stocks now make up more than 28% of the S&P 500 index. This can go on for some time, but it rarely ends well. Broad-based improvement in the economy should help even things out, and smaller companies appear poised to provide better returns than larger companies for a change.

As we look beyond the U.S., most of Asia has put the pandemic behind them and are showing signs of recovery and impressive growth. Cheaper valuations and the promise of global economic recovery offer a very attractive mix in overseas investments. Further economic weakness in the U.S. relative to the rest of the world combined with very low interest rates should put downward pressure on the dollar, further improving the appeal of overseas investments.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

While the pandemic has hit many emerging markets countries very hard, others have managed it fairly well. As global economies and global trade recover, emerging markets countries should benefit immensely.

One significant challenge remains for international equities. Even with the election of Joe Biden, trade tensions with China are not going away quickly. Republicans and Democrats, who can barely agree on the time of day, have found common cause in China’s trade and economic policies. Tariffs imposed by the Trump administration are unlikely to go away quickly, and a rapid thaw in the relationship is equally improbable.

Our Portfolios

Our stock exposure is currently broad based and weighted towards large U.S. companies, which have proven remarkably resilient so far. We are reviewing this exposure with an eye towards adding to our small company positions during the quarter. Our fixed income positions continue to provide stability and diversification, if less than exciting income in this period of low yields. We have also maintained a sizeable portion of our stock exposure in international funds and expect to benefit from decent growth and better valuations as economies begin to recover from the pandemic.

As always, we are here for you and we are ready to provide the guidance and planning you expect from us. If you have any questions about your investments or your financial plan, we would love the opportunity to discuss them with you.

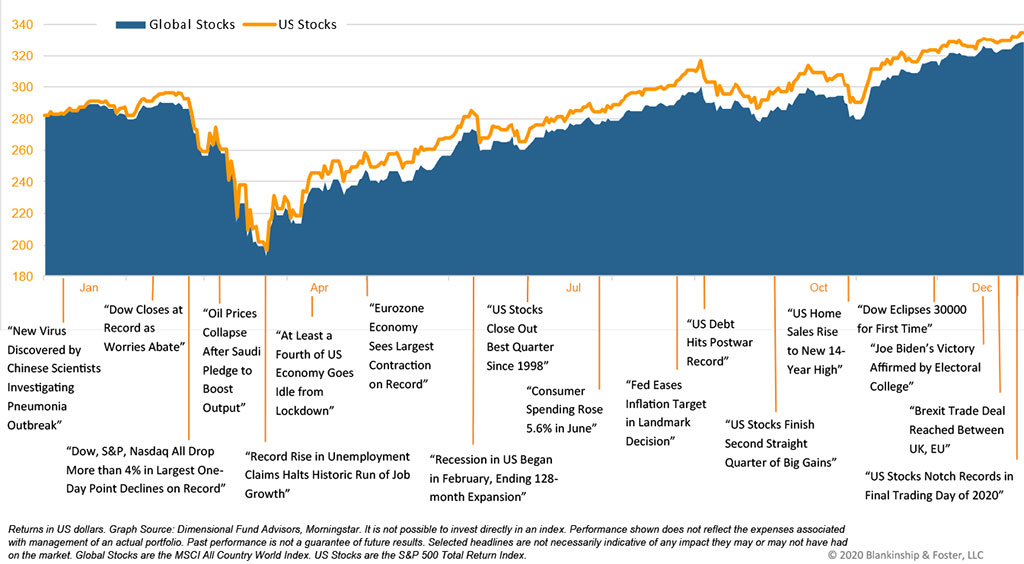

Global Stock Market Performance

The chart below shows the change in global equity markets throughout the year. Juxtaposed over the market performance are some of the key events that occurred during the period. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.