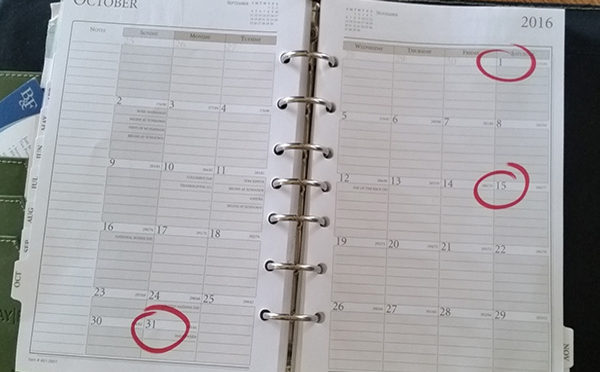

October is a big month for income taxes, and also for retirement plans and IRAs. Here are several important October financial planning dates to remember.

October 1

This is the last date to establish a Simple IRA for an existing business.

October 15

This is the due date for filing your tax return on extension. There are several IRA and retirement plan transactions that also have an October 15 deadline:

Solo and small business 401(k) contributions

The contribution deadline for contributions to a solo 401(k) is the company tax return deadline INCUDLING extensions. So if you extended your company tax return you can still make a 2015 contribution. For other small business 401(k)s, the contribution deadline depends on the type of contribution (employee salary deferral or employer contribution) and how the company is set up.

Roth Conversion Recharacterizations

A Roth IRA conversion can be recharacterized as late as October 15 of the year after the conversion. The recharacterization can be partial or complete. A complete recharacterization wipes out any tax liability from the conversion, and a partial recharacterization leaves part of the conversion in place.

IRA or Roth IRA Contribution Recharacterizations

IRA contributions and Roth IRA contributions can be recharacterized in the same way Roth Conversions can be recharacterized. The deadline is October 15 of the year after the year for which the contribution was made.

Removal of Excess IRA Contributions

The deadline to correct an excess IRA or Roth contribution without a penalty is October 15 of the year after the year for which the contribution is made.

As with recharacterizations, a net income calculation must be done when removing an excess contribution. You must make the custodian aware of a return of an excess contribution so that the 1099-R they issue can be coded correctly.

October 31

For an IRA owner who died last year and that have a trust as the beneficiary of their IRA, October 31 is the last day for the trustee to provide to the IRA custodian a list of a trust’s beneficiaries and their entitlement, in order to be able to stretch the required IRA distributions over the life expectancy of a trust beneficiary.

At Blankinship & Foster, we help you integrate your financial planning, estate planning and investment management, so you’ll feel confident you are moving towards your goals and are prepared for what lies ahead. If you have any questions about the October deadlines for your IRA(s) and retirement planning, please contact us today.