In the beginning of February we experienced something we haven’t seen in 400 days: a significant pullback in the stock market. After over a year of nearly continuous gains, we endured a turbulent week that pushed us into official market correction territory (a 10% or greater drop in stock prices).

In times like this, eye-catching headlines and sizeable declines in your accounts can test your resolve to stay invested. But then we remember that this is a normal part of investing. In fact, over half of the years between 1980 and 2017 endured annual market declines of 10% or greater.

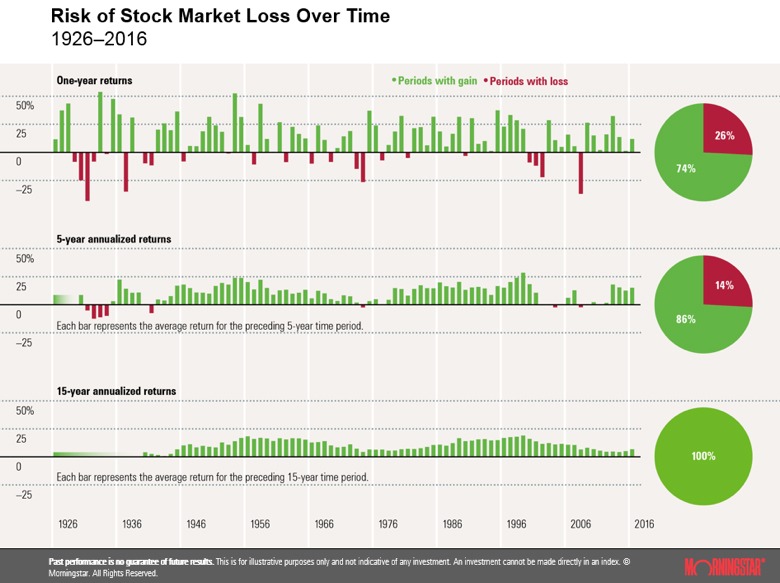

We also remind ourselves that money invested in the equity markets are meant to protect us against the very real but often silent risk of inflation. The cost of goods rises bit by bit over time, eating away at our purchasing power. Investments in stocks have shown to outpace rising prices over time. But not without big dips in between. The chart below shows returns of stocks invested over one-year, 5-year and 15-year time horizons. The risk of an investment loss is over 25% when we invest for only one year. It drops to 14% when we can keep it in the equity markets for 5 years. And for long term investors who are willing to stay in the market for 15 or more years, the likelihood of coming out ahead is very high.

Secret to Successful Investing

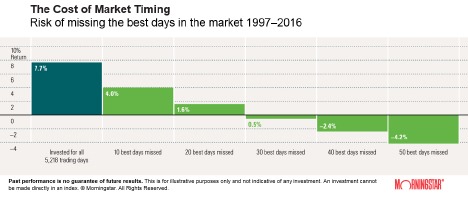

The secret to growing your portfolio is not what you do during market dips, but what you don’t do. Staying invested despite the scary headlines and that queezy feeling in your stomach is your best chance at building long term wealth. As illustrated in the graph below, if you missed the best 10 days in the market, your annualized return over a twenty-year period would be nearly halved. For a one-million-dollar portfolio invested in 1997, it would mean the difference between having $4.4 million versus $2.2 million at the end of 2016.

Timing the market is extremely difficult to do successfully. Not only do you have to decide when to sell your stocks, you also must correctly time when to re-purchase back into the market. You can use various measures to determine how expensive or cheap stocks are. But without a crystal ball, it’s impossible to predict if market will or will not move another 10 or 20 percent in either direction. The size of bubbles and crashes are driven by greed and fear. Your best course of action is to stay invested and periodically re-balance the assets to “sell high and buy low.”

What to Do If You Feel Jittery

- Review your portfolio allocation to ensure that it aligns with your current goals and capacity for risk.

If a sum of money will be used to fund a large short-term goal such as buying a house in three years, that money should not be invested in stocks, because there is not enough time to recover from a loss in such a short period.. If you are getting close to retirement and expect to soon start drawing from your investments, the allocation you should have to stocks and bonds depends on how heavy the withdrawal rate will be, and how soon the withdrawals will start. Even if withdrawals will start soon, it typically makes sense to keep some portion invested in the stock market. That is because much of the money can continue to grow over the long term, and you may need that growth in order to provide for a long retirement. If retirement is five years or less away, you should revisit your allocation between stocks and bonds to ready yourself for regular withdrawals. - Check if you have enough in liquid reserves (cash).

You should have a reserve fund with 3 to 6 months of living expenses set aside. The last thing you want to have to do is sell the stocks in your portfolio to pay for unexpected bills. If you have large periodic expenses such as property taxes or home maintenance projects, you should fund an additional account with one-year worth of such expenses. Your reserve account should only be used for unexpected expenses, such as a medical emergencies or roof leaks.

If you have a thoughtfully designed portfolio and adequate liquid reserves, then you can turn off the TV, pat yourself on the back and go back to enjoying your favorite activities.

Conclusion

The poet, Oscar Wilde, once said: “To do nothing at all is the most difficult thing in the world, the most difficult and the most intellectual.” When facing market volatility, “doing nothing” is almost always the best strategy, provided your investments are in alignment with your long term plan. Successful investing requires planning and patience. Just like fishing, you need to keep the line in the water to nab the next “big catch.”

We, at Blankinship & Foster, can help you clarify your goals, develop multi-year financial plans and build globally a diversified and professionally managed portfolio. We are here to help you with the financial “hows” and “whys” in your life. Contact us today to learn more about what we can do for you.