You’re going to be hearing a lot of people talking about how to ‘prepare your portfolio’ for the election results. I could make a case for lots of different possible outcomes, regardless of whom is ultimately elected. At the end of the day, though, the markets will have the final say, and it is likely to be different than what people are thinking now.

Trying to predict how the markets will react is often a fool’s errand. Nobody can predict the future, and our assumptions about what will happen and how one event will impact thousands of variables based on limited information is a monumental task. Investors’ expectations of how markets will react are often wrong. And besides, the next president will be operating in the same exact conditions that defined and guided the policy choices of the previous Administration, limiting his or her flexibility on policy options.

For example, if Joe Biden wins the election, it will not change China’s emergence on the world stage as a competitor for U.S. power and influence. Nor will it change the realization that shipping all of our manufacturing capacity to China might not have been a good idea, and that we may need to start working to bring some of that back to the U.S. And it won’t change the competition between Russia and Saudi Arabia for dominance of the oil market (or their joint desire to crush U.S. shale oil production). These are phenomenally complex issues, and investors’ snap judgements about how thousands of companies and millions of consumers will react on election night are almost certain to be wrong.

Fiduciary

We are fiduciaries, and it’s not just a word. It’s a binding commitment to put your interests first.

Furthermore, people’s assumptions about what a candidate will do once in office are often wrong. Few people in 2015 would have predicted that a Republican President would throw out the party orthodoxy that deficits were awful, and that financial ruin would be right around the corner if the budget wasn’t balanced.

The point is that trying to guess what will happen to the markets after an election is monumentally difficult. In the short run, investors can be spooked by surprises they had not considered or situations they thought were unlikely. The sharp reactions to the United Kingdom’s vote to leave the European Union (BREXIT) is a classic example of a negative surprise. But investors soon looked past the surprise, re-evaluated the economics and the likely impacts on company earnings, and adjusted their expectations accordingly. The result was that after a few days of volatility, markets quickly recovered. Investors who sold in panic were left behind. Those who sold in November 2016 expecting a disaster following the election of President Trump similarly missed a huge rally.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

Investors will focus on the fundamentals like inflation, economic growth, corporate earnings, etc. These are the factors that will drive stock prices higher (or lower), regardless of who sits in the Oval Office.

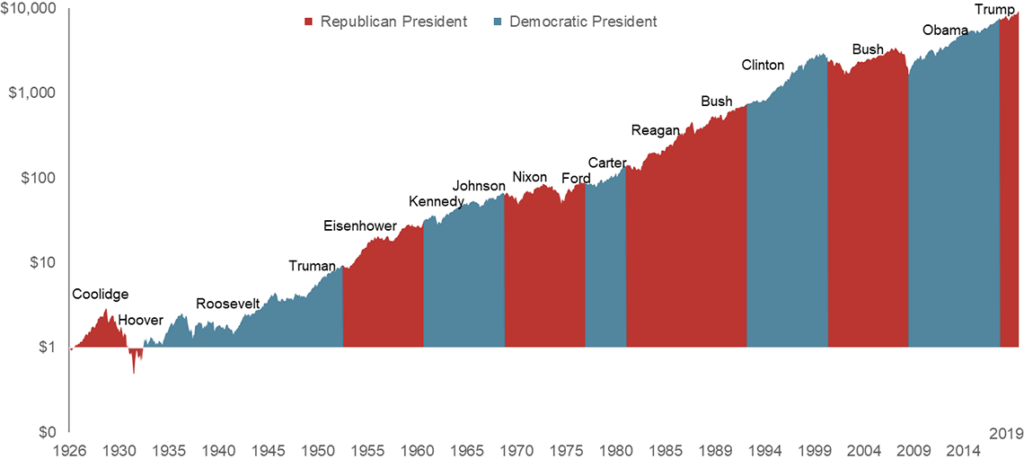

Many people assume they know which candidate will be better for investment markets. Dimensional Fund Advisors has a great chart showing the growth of a dollar across the 16 presidents since 1926. It shows that there is basically no party or president that is ‘better’ for investors. In fact, US Presidents are often given far more credit (or blame) than they deserve for the economy. Their policies can affect some aspects of the economy, but they do not work alone or in a vacuum. Congress has a significant impact through Federal spending (or belt-tightening) and world events affect outcomes as well.

Figure 1. Growth of $1 since 1926, Source: Dimensional Fund Advisors

History provides little evidence that people are able to manage short-term market timing successfully AND consistently. Trying to predict the market reaction to an election is no different. A far more reliable strategy is to decide on an investment mix that you can live with for a long time, hold your investments over 10 or 20 years and ride out the day-to-day volatility. And periodically rebalance to take advantage of other’s emotional reactions.

Investing is done amid a constantly changing set of conditions. There is always uncertainty, and there will always be surprises around the next corner. At Blankinship & Foster, we help you develop a plan for your investments that is integrated with your financial, tax and estate planning. With an integrated plan that allows for uncertainties, you can truly Invest with Purpose.