In February, stock and bond markets were rattled by fears of a menace that many had forgotten about: inflation. Since it has been so long since investors focused on it, we thought a little brush up on the topic would be in order.

What is inflation?

Simply put, inflation is an increase in prices. The most commonly used measure of inflation is the Consumer Price Index (CPI). CPI is an average of the prices for what consumers actually bought in eight categories: food, housing, clothing, transportation, medical care, recreation, education, and other services.

Critics of the CPI measure argue that the average price doesn’t reflect many people’s actual experience. This is because the prices of one category can increase differently than the overall average (example: the price of food has increased much faster than the CPI average over certain periods) and some people spend a lot in certain categories than others.

The above chart shows the increase in CPI each year for the last ten years. Though the rate has been up and down, the average has been just 1.7% per year, well below the long-term average of 3.2%.

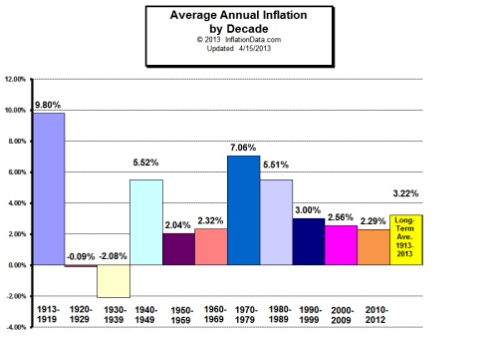

Though the 3% long term average is relatively mild, there are times when the inflation rate has stayed high for many years. The above chart shows the average inflation rate by decade. As you can see, there have been decades where inflation stayed well above 3% for years.

How inflation affects your money

When the cost of things you buy go up, you need more dollars to buy them. Said another way, your dollars don’t buy as much. This is the loss of purchasing power. For people on a fixed income, or if their income doesn’t increase, their wallet gets squeezed as the dollars they earn don’t buy as much of the things they need.

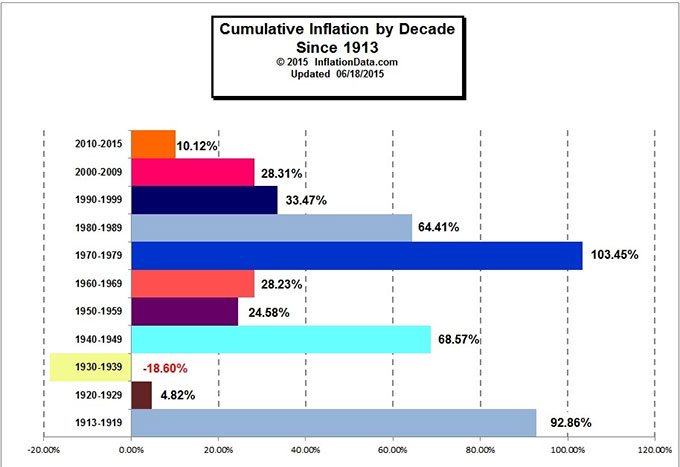

Over long periods of time, this loss of purchasing power is a powerful foe, especially if the rate of inflation is high. The above chart shows the cumulative increase in prices over decades. From 1970 through 1979, prices increased a whopping 103%. The purchasing power of a dollar held for those ten years was cut in half over that time.

At its worst, inflation can overtake your ability to save money and grow your retirement savings. If prices keep increasing at a high enough rate, you could end up with less purchasing power in retirement, even if you have saved a lot of dollars over your working years.

How inflation affects stocks and bonds

Inflation affects the value of bonds by influencing interest rates. When the federal reserve bank sees a threat of rising inflation, they raise rates, which has a cooling effect on the economy. This can cause investors’ bonds to drop in value. However, you can get a higher interest rate on new bonds, so a bond portfolio can work well when interest rates and inflation are rising, if it’s structured properly.

Inflation’s effect on stocks is more complex. On one hand, it can be a drag on a company’s earnings by forcing up the cost of wages, materials and borrowing costs. On the other hand, if the economy is running well and customers can absorb price increases, the companies’ profits can keep rising, along with their stock price.

What can I do to keep up with inflation?

Inflation is a normal force of nature. The best way to stay ahead of it is to increase your dollars faster than those dollars can lose purchasing power. That hasn’t been too difficult over the last five years, as inflation has been averaging only 1.3%. But when inflation is higher, the hurdle is harder to surmount. That’s where investments come in.

Savings accounts and CD’s may not earn enough to keep up with inflation. Bonds also may not keep up with inflation over time, especially if interest rates are rising fast. Stocks tend to do a good job of keeping up with inflation, if it is relatively mild (under 5%).

In times of high inflation, “hard assets” like commodities and real estate, and Treasury Inflation Protected Securities (TIPS) work well. But over long periods of mild inflation like we’ve seen over the last ten years, stocks (U.S. and worldwide) have done the best job of maintaining purchasing power.

Planning and investing in inflationary times

As you can see, keeping up with inflation can be tricky. But you can help preserve your purchasing power by taking these steps:

- Save enough of your income to build emergency funds and retirement savings

- Take advantage of income sources that pay Cost of Living increases, like Social Security and some pensions.

- Balance your investments with a mix of U.S. stocks, international stocks, and fixed income investments.

- Protect against interest rate risk by avoiding longer term bonds.

- Stay healthy! (Health care costs tend to rise even more than general inflation)

At Blankinship and Foster, we help our clients build long term wealth with balanced, properly managed investment portfolios and sound financial planning. Contact us to learn how we can help you.