One of the big changes that happens in retirement is with taxes. Not only in the amount of taxes you pay, but also how you will pay them. In planning for retirement taxes, it is important to factor in those changes. You may still end up paying taxes, but with planning and preparation, you can reduce the tax bite and eliminate unexpected surprises.

Here are five tax traps you can sidestep with good planning:

1. Estimated quarterly tax payments

Most people are accustomed to having taxes withheld from their paycheck. When you stop working, that tax withholding stops. But that doesn’t mean you stop owing taxes.

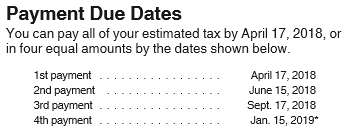

The taxes are due in quarterly installments during the year. Here are the due dates for 2018, as published by the IRS:

Failing to pay enough by the due date each quarter can cause underpayment penalties- a tax trap if there ever was one! You can help avoid underpayment penalties by having taxes withheld from pension payments, social security, or IRA distributions. If quarterly estimated payments are still required, your tax preparer can calculate the minimum amount you have to pay to avoid penalties.

2. Social Security benefits

Social Security retirement benefits are partially taxable. The portion that is taxed depends on your total income (called, “Provisional Income”). There are three tiers of taxability based on your Provisional Income. Depending on which tier you are in, none of the Social Security income may be taxable, 50% may be taxable, or 85% may be taxable.

FAQS

We’re happy to answer any questions you have about our firm and our processes. Here are answers to some of the questions we receive most frequently.

The tax trap to avoid is having some amount of income, say capital gains from selling stocks, push your provisional income up from one tier to the next, making more of your social security income taxable. You can avoid this tax trap by timing the extra income, or by lowering your Provisional Income. A contribution to a 401K or SEP IRA can lower Provisional Income, if you are eligible.

3. Medicare surcharges

This tax trap is a lot like the previous one. Medicare Part B and Part D premiums are reasonable, IF your gross income (called Modified Adjusted Gross Income, or MAGI) is below a certain point. If your MAGI is higher, you get hit with surcharges of between $134 and $428 a month for Part B, plus $13 to $74 a month for part D. Ouch! As with the Social Security income trap, you can avoid this one by lowering your gross (MAGI) income.

4. Required IRA minimum distributions

Required minimum distributions (RMDs) are minimum amounts that retirement account owners must withdraw annually, starting with the year they reach 70½ years of age (or later if you meet certain exceptions). The tax trap here is if you do not take the required amount of distributions before the end of the year, and you get hit with a 50% excise tax. Double ouch!

- Delaying your first RMD until April 1 of the year after you turn 70½, but then forgetting that you also must take another RMD by December 31 of that year.

- Not taking an RMD from your 401K because you are still working past age 70½, but terminating employment before the end of the year, making you subject to an RMD for the whole year.

A subtler tax trap is having large RMDs that push you into a higher tax bracket. Advance planning is required to avoid this one. You can begin taking distributions prior to 70½. Or, you could convert some of your IRA into a Roth, which will help shelter gains and future distributions from taxes.

ARTICLE

Invest $100K the Right Way

At some point, you may find yourself with $100,000 in the bank and questions on how to invest it.

5. Selling your primary residence

- You can turn illiquid real estate equity into liquid cash for retirement.

- You can reduce your expenses.

The tax trap is in not accounting for the capital gains taxes. Federal and state taxes may be due when you sell the house, and the 3.8% “Obamacare” tax on investment income could also be triggered. A lot of retirees are surprised by how much the taxes eat into the money they were counting on to bolster their retirement funds by downsizing.

IRS rules allow for an exclusion of up to $250,000 (single filers) or $500,000 (joint filers) from capital gains tax on the sale of a primary residence, if the house was your primary residence for at least 2 of the last five years. Traps await if you have rented the house out in the last five years. You could lose some or all of the exemption and also, if you have been taking depreciation write-offs while renting the house out, you could be subject to depreciation recapture taxes.

If all this sounds complicated, it’s because it is! Tax planning is a complex but very important part of your overall retirement tax planning. How we structure retirement income, your investments, and distributions from retirement accounts can all help to reduce your tax burden for years to come. At Blankinship & Foster, we design and implement financial and investment plans that “Get to How”. Please contact us to learn more about how we can help you.