Quarter in Review

The S&P 500 Index rose by nearly 4% in the third quarter, despite numerous uncertainties, including a U.S. presidential campaign that continues to unfold as the most unconventional in recent memory. Stock markets were relatively calm through July and August, but September seemed to usher in a change in tone. Investors reacted sharply to every oil-related headline or suggestion of interest rate hikes by central banks.

Since the “Brexit” low in June, international stocks have outperformed the S&P 500, though they still trail U.S. stocks for the year. Emerging-market stock returns have been particularly striking, building upon their sharp rebound that began in late January. Emerging-market stocks are now up 17% for the year.

Yields on U.S. 10-year Treasury bonds rose to as high as 1.75% during the quarter, but the Federal Reserve (Fed) ultimately did not raise interest rates in September. Yields ended the quarter at 1.56%, up modestly from 1.44% on July 1. An interest rate rise in December still seems likely, and financial markets remain keenly attuned to this possibility. The core bond index gained just 0.5% for the quarter.

Rising interest rates pose a significant risk to core bond returns, which is one of the reasons for our tactical positions in flexible fixed-income funds and other strategies. Our portfolios generally benefited last quarter from these positions, as they contributed strong absolute and relative performance compared to core bonds.

Portfolio Positioning

The gain in the S&P 500 occurred in the context of a market that saw sharp intraday drops followed by swift reversals. We continue to view U.S. stocks as somewhat overvalued relative to the risks over the next five years. We remain underweight to direct stock exposure while picking up some growth (and volatility) from our portfolio diversifiers. On the other hand, we continue to believe international stocks are cheap relative to U.S. stocks, and offer attractive potential returns.

The solid gains in emerging market stocks since January appear to have been driven more by investor optimism than improving fundamentals. Still, modest valuations and earnings growth potential make for interesting expected returns in this asset class over the next five years. Political and economic risks, like the rapid growth of debt in China, are well known and somewhat temper our enthusiasm.

Core investment grade bond funds make up the bulk of our fixed income allocations, providing income and offsetting stock market volatility. We continue to believe that the risks posed by expectations of rising interest rates warrant a significant underweight to core bonds (Treasuries, mortgages and investment grade corporate bonds) and a significant allocation to other portions of the bond market.

That said, these non-core bond holdings do have different risks than core bonds in some scenarios. We believe the added credit risk is offset by our underweight to U.S. stocks, and these positions should outperform core bonds in either a flat or rising rate environment.

We are pleased many of our tactical positions added value in the third quarter, but reiterate our exposure is based on our longer-term time horizon and assessment of their potential returns and risks.

Putting It All In Perspective

In portfolio management the whole is much more than simply the sum of its parts. We spend time analyzing each of our individual positions and holdings. However, by definition, a well-diversified portfolio (with investments that do not all move together in the same direction) will contain some laggards during any given period, particularly over shorter-term periods. It’s as important to focus on the overall portfolio, how the pieces fit together and perform relative to each other, and whether that performance is consistent with the original rationale for owning them.

We believe successful portfolio management also requires an investment approach based on a range of potential outcomes and a longer-term time frame. Since 1950, the stock market has fallen by at least 10% every 16 months or so, and declines of more than 20% happen (on average) about every seven years. In most cases, you can’t predict what the exact cause of volatility will be or exactly when it will hit. Even if you could, you’d need to correctly time both your exit and your re-entry, and do so consistently and repeatedly over a lifetime. That is not realistic, so the discipline to resist trading based on emotion—rather than on long-term return drivers like valuations, yield, and earnings growth—is essential.

For example, consider the U.S. presidential election, which has come up in client meetings even more than usual this year. While the specific circumstances of any given election are always unique, our approach remains the same. Current asset prices reflect the market’s consensus expectation. There is too much uncertainty and far too many variables that impact investment outcomes for us to be able to adjust our portfolios for a specific result. Instead, we stick to our longer-term analytical framework, in which we consider and weigh macro scenarios and assess the potential risks and returns for investments in each.

Another example is the Fed’s decision about whether or not to hike interest rates later this year, tempting traders to predict not just the direction of the Fed’s action, but also the markets’ reactions to it. Disciplined investors will sit tight and follow fundamentals like corporate earnings growth, inflation, and the strength of the underlying economy.

We attempt to anchor our decision-making in a long-term fundamental and valuation-driven approach. Periods of market stress will happen, and we must be prepared to ride them out on the path to achieving long-term financial goals. We work hard to select a portfolio that fits each clients’ risk appetite because the middle of a downturn is not the time to make changes.

We structure our balanced portfolios across a well-diversified mix of investments, each with a distinct role. We expect them to be resilient and to perform at least reasonably well across a wide range of outcomes, balancing our objective of long-term capital appreciation with shorter-term downside risk management appropriate for each client’s risk tolerance.

While July and August were unusually calm months for the markets, volatility returned in September. We are prepared for more of it heading into the election and beyond. As always, we appreciate your confidence and welcome any questions you might have.

Download this Third Quarter 2016 Investment Review as a PDF (197kb). View reports on past quarters here.

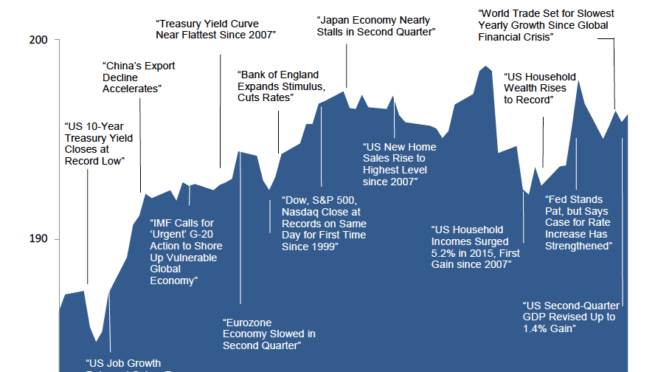

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

†Returns in US dollars. Graph Source: Dimensional Fund Advisors, Morningstar. It is not possible to invest directly in an index. Performance shown does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results. Selected headlines are not necessarily indicative of any impact they may or may not have had on the market. *Board of Governors of the Federal Reserve System.