As the quarter drew to a close, all eyes were being drawn to Greece in echoes of 2011. Greece made headlines for its June 30 default on a debt payment to the International Monetary Fund (IMF) amidst increasingly fraught negotiations with its Eurozone creditors. Meanwhile, China was in the news for its very sharp short-term stock market decline and surprise interest rate cut, and Puerto Rico announced it would be unable to fully repay its municipal debts. Gains early in the quarter faded amid concerns about global volatility and the future path of interest rates here in the U.S.

U.S. large cap stocks saw only a mild gain in the second quarter but have been positive thus far in 2015. Developed international and emerging-markets stocks outperformed U.S. markets through the first six months of the year. Despite issues related to Greece, European stocks gained 3.9% for the year through June 30. Among larger emerging markets, China was a strong positive contributor for the second quarter despite its June decline.

Diversification in our fixed-income allocations also benefited our portfolios. Core bonds declined in the second quarter as Treasury yields rose (bond prices and yields move opposite to each other). Our allocation to diversifying (alternative) funds generally outperformed the broad bond market.

How We View the Big Picture

We often use the term “big picture” as shorthand to represent the many external forces like global economic cycles, monetary and fiscal policy, national elections, geopolitical conflicts, and so forth. These events shape the environment in which we invest. This past quarter, the outlook for Greece and the European Union as a whole was a dominant one.

The timing of the U.S. Federal Reserve’s (“Fed”) first interest rate hike is another example, with many investors and economists anticipating the Fed will take this much-watched step in the fall or early winter. In its most recent policy statement, the Fed itself suggested a rate increase may be warranted this year, but thus far improvement in the employment picture and inflation have not been sufficient to warrant the change.

These kinds of events fall into the category of important but unknowable. As such, they warrant some attention from us but not, in most cases, a specific reaction. Instead, our approach is to consider a range of potential outcomes that inherently encompass a variety of risk scenarios and then build portfolios that we believe are resilient and robust across this range.

Current Positioning

We remain conservatively allocated to U.S. stocks in our balanced portfolios. Looking out across our five-year investment time period, the potential returns just are not high enough to fully compensate us for the risks.

We evaluate the attractiveness of stocks by analyzing the five-year outlook for company earnings relative to stock prices across a variety of economic scenarios we believe are plausible. By this standard, U.S. stocks look less attractive, offering fairly modest return potential over the next five years in our base case scenario.

With corporate profit margins at historically high levels and stock prices expensive, the potential for earnings to disappoint the market’s expectations (as reflected in those high prices) is substantial. Looking back at just the past year, S&P 500 profit margins, while still high, have turned down over the past two quarters. Meanwhile, expected earnings for these companies have been steadily coming down since last year. This combination does not bode well for future stock prices.

We know U.S. stocks may continue to deliver attractive returns over short- or intermediate-term periods, and factors like supportive monetary policy can be a powerful influence. However, we continue to believe there are better opportunities for our portfolios outside the U.S. market.

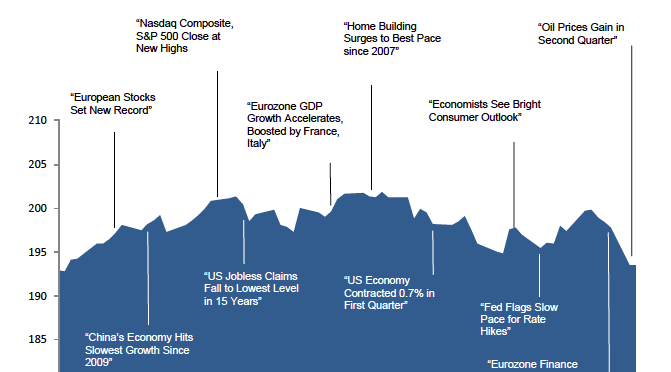

This chart shows the change in global equity markets throughout the quarter. Juxtaposed over the market performance are some of the key events that occurred during the quarter. Sometimes as we get to the end of a volatile period, it’s difficult to look back and remember everything that happened along the way.†

We have increased our tactical allocation to international stocks during the second quarter following our assessment that expected returns are very attractive relative to U.S. stocks. European stock market prices and corporate earnings still have room to improve, both on absolute terms and relative to the United States. While the situation in Greece will probably lead to more market volatility over the near term, we believe we have adequately factored a reasonable worst case outcome into our 12-month downside stress test scenarios for our portfolios.

Our top-down view for emerging-markets stocks is similar to our analysis for European stocks—their prices look attractive relative to other opportunities. We attempt to consider risks that are specific to emerging markets, namely the potential for a sharper slowdown of growth in China and the risk from a stronger U.S. dollar. However, even when we include these factors, our analysis still shows compelling return potential relative to U.S. stocks over our five-year investment time horizon.

On the fixed-income side, we are maintaining a significant underweight to traditional core bonds and interest rate risk, in favor of more flexible bond funds, absolute-return-oriented bond funds, and other non-correlated investments.

We also continue to see long-term value from exposure to alternative strategies. While this has been a headwind to overall portfolio performance during extended periods of stock market gains, we continue to believe they are an important source of diversification that offers solid return potential and volatility reduction.

Looking ahead, there are inevitably going to be shorter-term surprises, both positive and negative. The potential for surprises should not be “surprising,” though we know they will still feel uncomfortable for many investors. This is why it’s so important to take a long-term investment view when it comes to positioning our portfolios. Moreover, when markets over-react to shorter-term news or outcomes, this can create compelling longer-term investment opportunities—tactical asset allocation “fat pitches” for us.

As always, we appreciate your confidence and welcome questions about your individual portfolio.

Download this Second Quarter 2015 Investment Review report as a PDF (115kb). Visit our archives for reports on past quarters.

†Returns in US dollars. Graph Source: Dimensional Fund Advisors, Morningstar. It is not possible to invest directly in an index. Performance shown does not reflect the expenses associated with management of an actual portfolio. Past performance is not a guarantee of future results. Selected headlines are not necessarily indicative of any impact they may or may not have had on the market. *Board of Governors of the Federal Reserve System.